Jan 21, 2022

Barclays Sees Treasury Liquidity Ripples as the Fed Beats Retreat

, Bloomberg News

(Bloomberg) -- Barclays Plc’s strategists see some ripples in an otherwise smooth-functioning Treasury market as the Federal Reserve slows its bond-buying spree.

With the central bank reducing its purchases as it moves closer toward raising interest rates, analysts Anshul Pradhan and Andres Mok said in a research note that there are signs of some rising dislocations in the Treasury market.

For shorter-dated securities, there’s been a slight widening of bid-ask spreads, a signal of decreased liquidity.

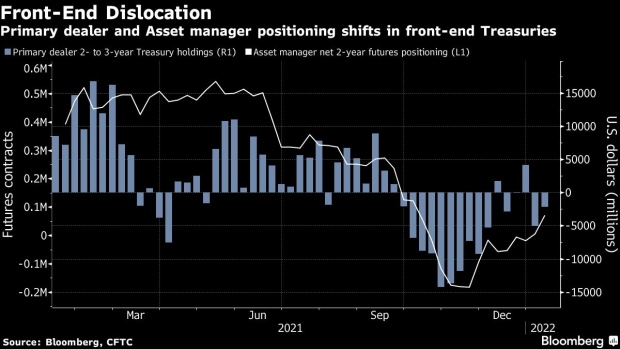

They said valuations across the front-end of the yield curve have also been pressured by an increase in dealers’ inventories, which could continue if their stockpiles keep growing.

Further out on the curve, pricing dislocations have also risen in 10- to 22.5-year Treasuries, “though they are typically more volatile given the dynamics in that sector.”

Such signals of how the Fed’s retreat may weigh on the market’s functioning is drawing renewed attention ahead of the bank’s meeting next week, when it may move to wind down its purchases more rapidly.

Despite some early impacts, however, the Barclays analysts said the Fed’s repurchase facilities -- which will provide an avenue for banks to exchange bonds for cash -- should prevent the market from being battered by a major drop in liquidity.

“The Fed’s permanent repo facilities should help support funding markets, preventing a repeat of the events from September 2019 and March 2020,” the analysts said.

©2022 Bloomberg L.P.