Feb 28, 2019

Barrick, Newmont race to plead merger cases to investors

, Bloomberg News

Executives at Barrick Gold Corp. (ABX.TO) and Newmont Mining Corp. (NEW.N) are racing to sway a core group of top investors with stock in both companies to support their own mega-merger over that of their rival.

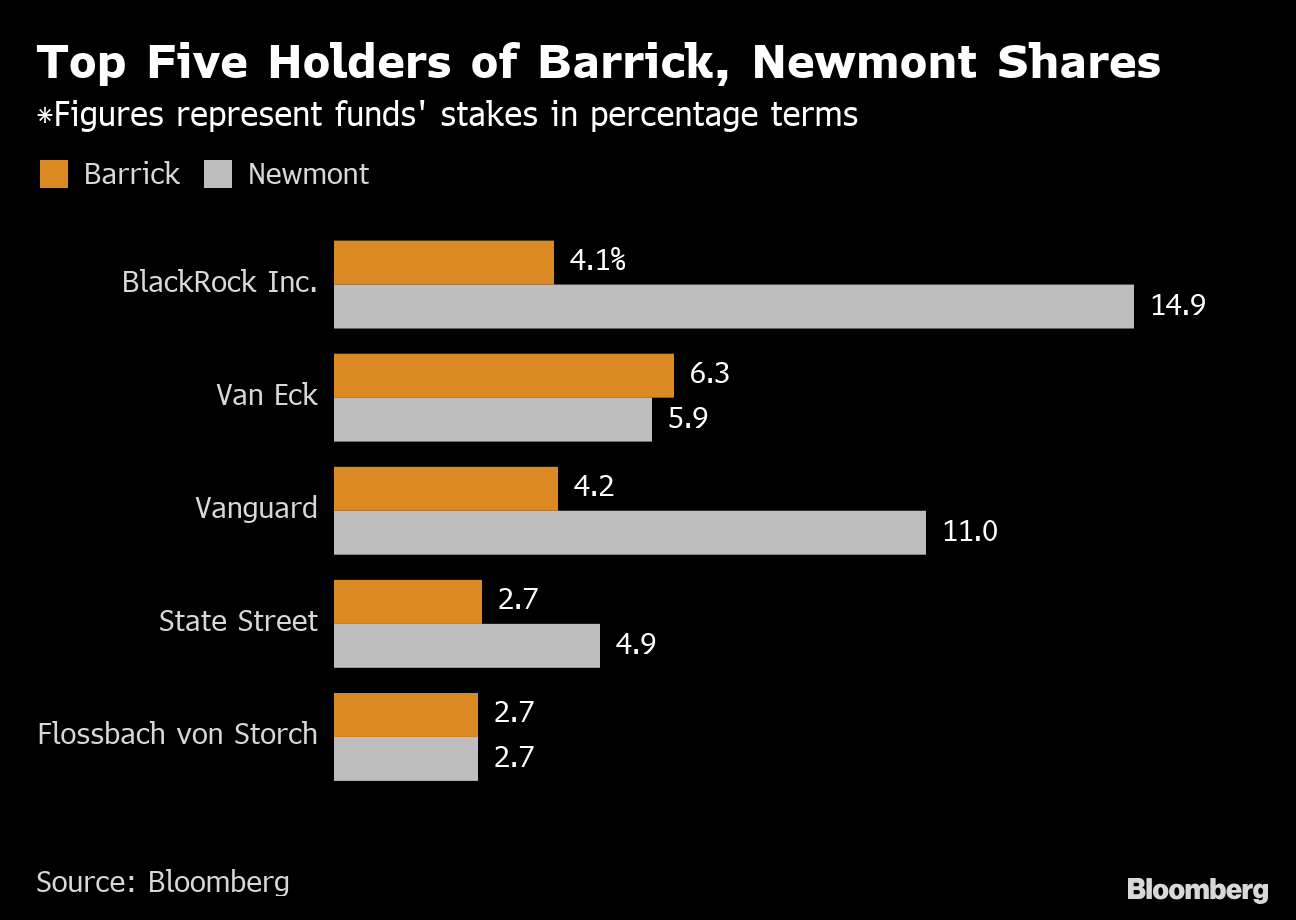

Canadian giant Barrick wants Newmont shareholders including BlackRock Inc., VanEck, and Flossbach von Storch AG to back its no-premium hostile bid for the Colorado-based miner. That could force Newmont to walk away from its US$10 billion agreement to buy Goldcorp Inc.

The top 20 holders in Barrick, who own 55 per cent of total shares outstanding, also own 91 per cent of Newmont’s shares,” according to Andrew Cosgrove, an analyst with Bloomberg Intelligence. “So it’s clear that Newmont management may have a tough time fighting against shareholders,” were those shareholders to support Barrick, he said.

The winning deal will turn on a few key issues, including added value, cost savings, potential risks and, perhaps above all else, the trust accorded to each executive team. With just over a month left until until shareholders of Goldcorp and Newmont vote on their merger, the biggest stockholders are holding their cards close to the vest. Smaller investors, though, are coming out firing.

Those favoring Barrick cite their faith in Executive Chairman John Thornton and Chief Executive Officer Mark Bristow, pointing to Barrick’s merger with Randgold Resources Ltd. -- which Bristow founded -- as proof the men can add value. "I like the Barrick management team," said David Neuhauser, managing director of Livermore Partners, which has a small stake in Barrick.

“This would create just a mammoth company, which would provide a lot of liquidity for generalists,” Neuhauser added.

On the other side is James Rasteh, founder of Coast Capital LLC, which holds a small stake in Newmont. “The people who should be calling the shots in a zero premium merger are the better managers, and that’s Newmont,” Rasteh said by phone. Bristow’s claims of $7 billion in pre-tax synergies may not be “within the bounds of credibility,” he said, adding that Barrick should be paying a premium if it believes its own numbers.

Meanwhile, Joe Foster, a fund manager at VanEck, with much more on the line in all three companies, said he’s still analyzing the situation. VanEck is Barrick’s largest shareholder with 6.3 percent of shares outstanding and the third-largest holder for Newmont with 4.9 percent of shares. It also holds 6.2 percent of Goldcorp Inc.

Paige Hoffman, a spokeswoman for BlackRock, declined to comment. Simon Jaeger of Flossbach von Storch said his company is not yet ready to comment.