Aug 3, 2021

Base Metals Drop as Covid, Manufacturing Slowdown Hit Sentiment

, Bloomberg News

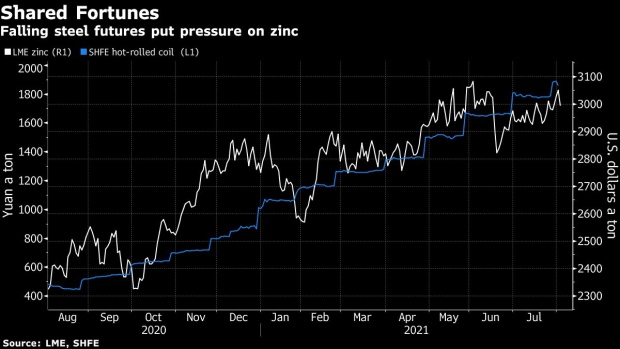

(Bloomberg) -- Zinc paced declines in base metals, with losses in Chinese ferrous markets weighing on the steelmaking material and risks from the spread of Covid-19 damping broader investor sentiment in commodities.

China’s virus defenses are being tested by the fast-spreading delta variant, with commodities there taking a hit as authorities step up curbs. Zinc, used in rust-proofing, fell the most in more than six weeks as steel futures were under pressure on the Shanghai Futures Exchange, while copper dropped for a third day after reports showing softer manufacturing growth in the U.S. and China.

“Industrial metals are increasingly feeling the weight of a synchronized slowing in U.S. and Chinese growth,” TD Securities analysts led by Bart Melek said in a note.

Zinc fell as much as 3% to $2,960 a ton on the LME and settled down 2.7% at $2,969.50 at 5:51 p.m. in London. All other main LME metals fell, with copper down 1.6%.

- Supply concerns faded in the nickel market as union leaders at Vale SA’s Sudbury nickel-copper complex in Canada unanimously recommended striking workers accept a new contract proposal.

©2021 Bloomberg L.P.