Jun 17, 2022

Basis Trade Blowup Adds New Drama to BOJ Fight With Bond Market

, Bloomberg News

(Bloomberg) -- Pockets of Japan’s bond market are imploding as the central bank battles to keep control of its policy goals and beat back those betting against it.

A small tweak to the Bank of Japan’s bond purchase plan this week blew up an arbitrage strategy popular with overseas investors known as the basis trade. It exacerbated a supply shortage of government bonds that has ramped up pressure on domestic financial institutions, leading them to turn to the BOJ for help to relieve the strain.

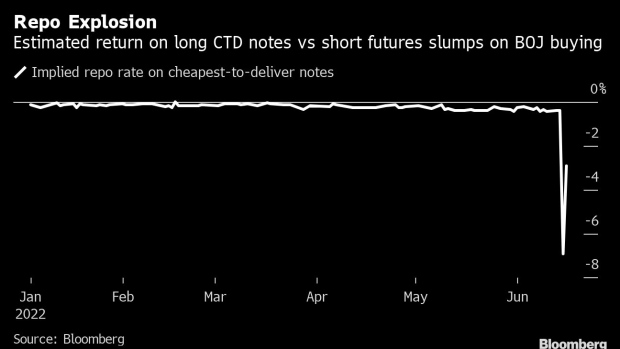

On Wednesday, after four straight days of declines in Japanese bond futures, the central bank announced unlimited purchases of so-called cheapest-to-deliver 10-year notes for Thursday and Friday -- securities closest linked to the contracts. That sent the spread between the futures and the bonds underlying them soaring to the widest since 2014 -- a massive shock for traders with positions between the two.

Arbitrageurs who were short the cheapest-to-deliver bonds and long the futures contracts suddenly faced steep losses and huge difficulties in closing their positions. The BOJ had effectively cornered the market in the cheapest-to-deliver bonds making it almost impossible for others to purchase them, while the futures price slumped to the brink of a trading halt as those caught out rushed to close.

An estimate of the cost to close this so-called short basis trade widened to about minus 7% on Wednesday from minus 0.4% the day before, according to data compiled by Bloomberg. It remained at distressed levels Friday -- around minus 2% -- suggesting some investors were still stuck on the wrong side of the trade.

“The selloff in futures has killed arbitrage opportunities,” said Mari Iwashita, chief market economist at Daiwa Securities. “This situation will eventually end up in a total stalemate in markets.”

Speculative attacks on Japanese bonds have mounted as investment funds bet the BOJ will cave in to pressure and change its increasingly isolated super-easy monetary policy. The central bank confounded its critics Friday, holding firm with its rock-bottom interest rates and continuing with its fixed-rate bond purchase plan.

Benchmark bond yields fell further below the 0.25% ceiling, after the central bank announced a fixed-rate purchase operation for the afternoon.

Bets the Bank of Japan Will Break Are Popping Up Across Markets

But those purchases are also sucking up liquidity, piling pressure on local institutions, something which can be seen in the usage of the BOJ’s lending program -- another gauge of stress in the market.

The amount of bonds it lends temporarily to financial institutions to relieve supply tightness has hit a record, according to data compiled by Bloomberg. The BOJ lent 3.2 trillion yen ($23.9 billion) of JGBs through its Securities Lending Facility on Thursday, well above the 2.3 trillion yen lent at the peak of coronavirus fears in March 2020.

Governor Haruhiko Kuroda told reporters on Friday that the BOJ will take appropriate measures to address any decline in bond market liquidity. He said he isn’t thinking about raising the 10-year yield ceiling from 0.25%.

“Market functioning and liquidity have deteriorated sharply with the BOJ’s massive JGB purchases,” Barclays strategist Shinji Ebihara wrote in a note.

(Adds BOJ Governor Kuroda’s comment in penultimate paragraph.)

©2022 Bloomberg L.P.