Jun 30, 2022

Bear Market Looms for Taiwan Stocks After a Chipmaker-Led Slump

, Bloomberg News

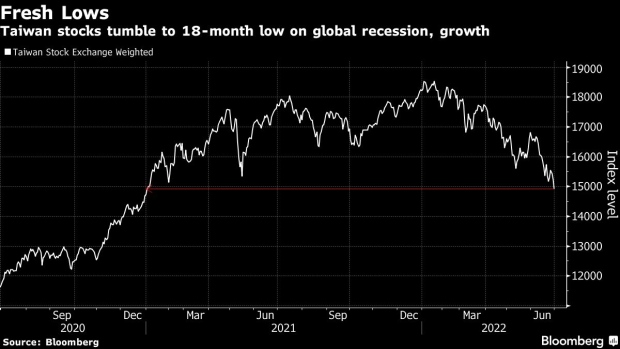

(Bloomberg) -- Taiwan’s stock benchmark index slumped on Thursday, taking its decline from a January high to over 19% and just points away from a so-called bear market.

The Taiex gauge closed 2.7% lower in Taipei, the worst performer in Asia. It was dragged by chipmakers after Bank of America took a cautious view on the industry’s growth prospects. Taiwan Semiconductor Manufacturing Co., which accounts for more than a quarter of the index’s weighting, dropped 3.1%.

Facing headwinds of rate hikes by global central banks, tech-heavy stock markets in Taiwan and Korea have been the worst performers in Asia this quarter, both down over 15%. Foreign investors have net sold about $16 billion of Taiwan stocks during the three-month period, the most among emerging Asia countries outside China.

Taiwan’s deputy finance minister said the National Financial Stabilization Fund will continue to closely monitor the stock market to see if it needs to step in. Taiwan Stock Exchange also said in statement that it will adopt stabilizing measures if needed when there are “irrational” declines in the stock market.

Societe Generale SA Thursday downgraded Taiwan stocks to underweight from neutral, citing external risks including tighter financial conditions and global growth slowdown fears.

“Global tech stocks are facing P/E re-rating, mainly due to recession and inflation concerns,” said Diana Wu, senior manager at Capital Securities Corp. “It’s a global issue as rate hikes normally hit tech stocks. Investors are withdrawing cash from TSMC and other Taiwan tech stocks.”

(Updates with closing prices throughout and analyst downgrade in the sixth paragraph)

©2022 Bloomberg L.P.