Jan 12, 2021

Bearish Bets Against Ark ETFs Are Surging After ‘Meteoric’ Rally

, Bloomberg News

(Bloomberg) -- A cohort of contrarians are wagering that the torrid streak for the top three exchange-traded funds managed by Cathie Wood will soon fizzle out.

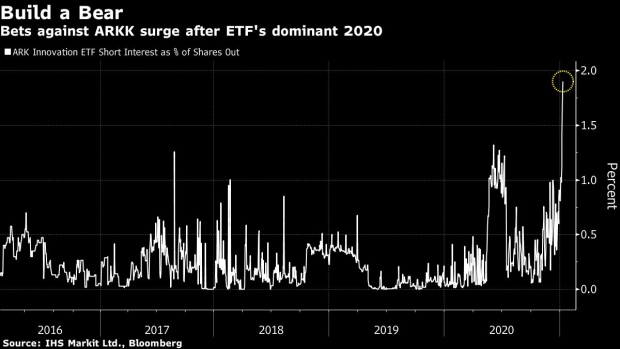

Short interest as a percentage of shares outstanding on the flagship $21 billion ARK Innovation ETF (ticker ARKK) jumped to an all-time high of 1.9% from about 0.3% a month ago, according to data from IHS Markit Ltd. A similar spike can be seen across the Ark Investment Management lineup, with bearish wagers on the $9.4 billion ARK Genomic Revolution ETF (ticker ARKG) and the $5.9 billion ARK Next Generation Internet ETF (ticker ARKW) also near records.

The surge in bearish bets comes after a banner year for Wood’s company, led by the Tesla-heavy ARKK, which skyrocketed almost 150% and attracted $9.6 billion of inflows in 2020. That winning trend has continued into 2021, with the fund notching its best week since April. Given the magnitude of ARKK’s outperformance, it’s “utterly unsurprising” that short sellers are setting their sights on the fund, according to Dave Nadig of ETF Trends.

“You can’t expect any shortable asset to have the kind of meteoric rise ARKK has had and not attract almost mechanical short-selling,” said Nadig, chief investment officer at the research and data provider. “There are, quite literally, traders who have screens for ‘ETFs that went up X far over Y time’ to use as contrarian short indicators.”

Ark’s ETF lineup has already absorbed $3 billion so far this year, bringing total assets to $41 billion from just $3.5 billion a year ago, according to data compiled by Bloomberg. That influx has pushed Ark into the ranks of the top 10 biggest issuers in the $5.5 trillion ETF industry.

However, that flood of money could end up inhibiting funds like ARKK, which aims to invest in smaller, innovative companies in addition to giants such as Tesla. ARKK had more than 10% of floating shares in 15 of its 52 holdings in late December, according to a Bloomberg Intelligence report. That heavy degree of ownership, combined with seemingly nonstop inflows, could make it difficult for ARKK to move in and out of smaller stocks without impacting the price or increasing the risk of getting front-run, according to BI analyst Eric Balchunas.

Wood -- long a believer in Tesla and Bitcoin -- emerged as a star manager in a year that was largely punishing for active investors.

“The Ark phenomenon is the first time ever that a rock-star portfolio manager has been shortable,” Balchunas said. “Typically, they’re in a mutual fund or a hedge fund, which you can’t short. This is breaking new ground in a way,” he said.

©2021 Bloomberg L.P.