Feb 1, 2023

Bearish Momentum Sweeps Through US Rates Market Just Before Fed

, Bloomberg News

(Bloomberg) -- While swaps tied to the Federal Reserve’s benchmark interest rate show a near 90% probability that the central bank announces a 25 basis-point rate hike on Wednesday, traders are leaving nothing to chance.

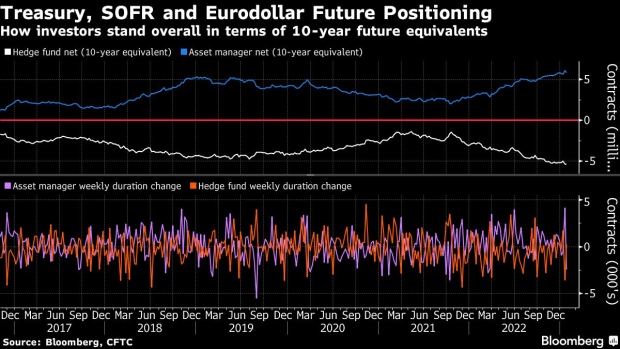

Monday saw two big trades in federal funds futures that would pay out if the central bank opts to surprise with a 50 basis-point rate hike instead. And the latest weekly positioning data from the Commodity Futures Trading Commission showed asset managers have been closing out long-duration positions, while hedge funds have extended a net short position in 10-year Treasuries to multi-year lows.

The latest JPMorgan Treasury positioning survey has also shown clients moving into shorts, and positioning is now at its most bearish in seven weeks.

The following is a rundown of how positioning has unfolded in various markets:

Asset Managers Unwind

In the week through Jan. 24, CFTC futures positioning showed asset managers were turning bearish on duration, unwinding long positions from the belly of the curve out to the long end for a combined $15.1 million per basis point in risk. Most liquidation was seen in 10-year note contracts — where hedge funds were also bearish on the week, extending their net short to the most since December 2019.

Skew Near Neutral

Skew on 10-year note futures has remained close to neutral, with yields continuing to hover between 3.45% to 3.55% over the past week. The trend toward neutral in recent months marks a reversal from the fall, when skew favored put options, as traders pay a diminishing premium to hedge against a Treasuries selloff.

Heat Map

A heat map of outstanding positions in March 10-year options shows elevated risk, reflecting a large condor trade in put options targeting a yield range of 3.75% to 3.90%. However, activity Tuesday appeared to reflect the start of an unwind of this position over the course of the session.

SOFR 95 Option Strike Active

Open interest in options tied to the Secured Overnight Financing Rate remains elevated in the 95.00 and 95.50 strikes across a number of tenors. Flows around the strike have included a roughly 115,000 position in Sep23 95.00/95.50/96.00 call flies and 75,000 Dec23 95.00/95.50/96.00 put flies.

Blocks Ease

There were few notable block trades last week. The most active contract was the 10-year note future, where flows included a 9,213 buyer at 114-22 and a 4,000 seller at 114-28. In total, around 30,000 traded in 10-year note futures via blocks last week.

©2023 Bloomberg L.P.