Nov 23, 2022

Bearish US Oil Gauge Signals Break From Physical Fundamentals

, Bloomberg News

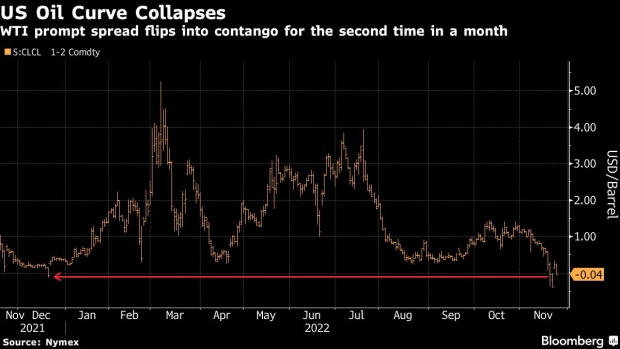

(Bloomberg) -- A key oil gauge again flashed oversupply signals despite US crude inventories tightening, in the latest sign that the futures market is trading out of sync with typical physical cues.

The US oil futures curve flipped into a bearish market structure known as contango for the second time this month as traders shrugged off a bullish government report showing supplies at the key Cushing, Okla., storage hub shrank to a two-month low.

Typically, the spread between barrels for first- and second-month delivery move in tandem with Cushing inventories. But expectations that Russian oil will continue to flow despite European sanctions taking effect in December, as well as weakening demand in China, are prompting traders to exit bullish positions ahead of the US holiday.

The same thing happened last week, when US crude’s prompt spread flipped into contango for the first time in about a year.

Contango can have significant ripple effects across the market. For physical traders, it could create opportunities to store oil and sell them at a later date for higher prices. For financial traders, it could lead to so-called negative roll yield, where investors tend to lose money when they roll a position forward from one month to the next.

©2022 Bloomberg L.P.