Feb 26, 2021

Beckham-backed cannabinoid firm Cellular Goods soars in U.K. IPO

, Bloomberg News

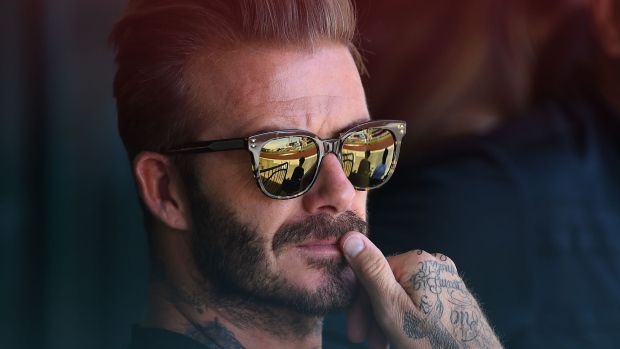

Cellular Goods Plc, which is backed by retired soccer star David Beckham, surged more than fourfold as it started trading in London after raising 13 million pounds (US$18.4 million) in an initial public offering, part of a rush of cannabis-related listings in the City.

The stock soared 310 per cent to 20.50 pence at 8:15 a.m. in London from its IPO price of 5 pence. The offering valued the company at 25 million pounds.

Cellular Goods, which is developing skin-care and topical creams to provide relief for athletes, said demand for its IPO exceeded the deal size 13 times, helping it raise more than the original 8 million-pound target. The company’s cannabinoids are made in a lab, rather than being derived from plants.

“David Beckham’s backing of a cannabinoids company has certainly added a puff of star power to its listed debut,” Hargreaves Lansdown Plc analyst Susannah Streeter wrote in an emailed statement.

Cellular Goods’ products will be available in September, according to its website. Its offering was supported by about 6,000 orders from retail traders, who were allocated a smaller portion of shares than they subscribed for as a result of the high demand, according to a statement.

The global cannabidiol skin products market alone is forecast to grow by a quarter over the next five years to almost US$3.5 billion, “but already it’s a highly competitive field, with innovations coming thick and fast from all over the world,” Streeter said.

Cellular Goods aims to demystify the market for consumers, Chief Executive Officer Alexis Abraham said in an interview. “The cannabinoid market at the moment is akin to the early days of the Internet,” he said. “There are a lot of firms in the market but customers don’t quite know what products or dosage they should be consuming.”

The London Stock Exchange has seen a flurry cannabis-related listings this year, a few months after the British market watchdog said marijuana firms can float on the bourse, but only if they produce the drug for medicinal purposes. Medical pot was legalized in the U.K. in 2018 for a narrow set of purposes, but recreational use is against the law.

Israeli firm Kanabo Group Plc, which makes inhalation devices for medicinal cannabis formulations, and MGC Pharmaceuticals Ltd., which is developing cannabis-based epilepsy and dementia drugs, have tested investor appetite for such pot stocks in recent weeks. Kanabo is up 65 per cent, while MGC has jumped 232 per cent since listing this month.

Beckham’s DB Ventures holds a 5 per cent stake in Cellular Goods and has two board seats. It has supported other recent IPOs including Guild Esports Plc, which in October became the first esports franchise to join the LSE. The stock has lost 20 per cent since its October debut.

Track the ongoing growth of the Canadian recreational cannabis industry here, and subscribe to our Cannabis Canada newsletter for the latest news delivered directly to your inbox every week.