Jun 29, 2022

Bed Bath & Beyond Fallout Offers a Warning to Meme-Stock Traders

, Bloomberg News

(Bloomberg) -- Investors betting that Bed Bath & Beyond Inc. would be the next meme stock to go to the moon are facing the harsh reality that fundamentals are particularly important during a market rout.

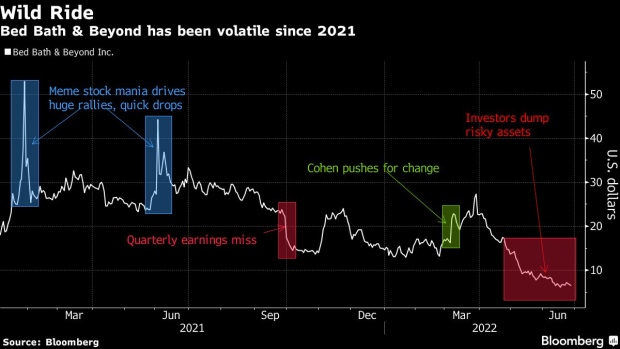

Shares of the home-goods retailer sank 15% in premarket trading Wednesday, on pace to open at the lowest since May 2020, after the company reported disappointing earnings. It follows a tumultuous two-year stretch when the company captivated retail traders alongside stocks like GameStop Corp. and AMC Entertainment Holdings Inc.

“The retail investor is learning a tough lesson as all the favorite meme stocks are getting crushed,” said Ed Moya, senior market analyst at Oanda. “The outflows for Bed Bath & Beyond, a favorite retail stock, have been significant and the coordinated buying is not happening.”

Bed Bath & Beyond’s quarterly loss was wider than analysts expected and first-quarter comparable sales and net sales also fell short of estimates. Vital Knowledge’s Adam Crisafulli said “investors expected the worst out of Bed Bath & Beyond, and they still disappointed.”

Just minutes before releasing earnings, the Union, New Jersey-based company named Sue Gove as its interim chief executive officer, replacing Mark Tritton.

The company was caught up in the meme stock mania at the start of last year and again that June as investors snapped up shares in a coordinated effort channeled through social media platforms. Another big jump came in March this year when Ryan Cohen’s investment firm RC Ventures called for a shake-up at the company, but the move failed to gain momentum as meme stocks and riskier assets faltered. The company’s market value soared to a peak of $6.4 billion in January 2021, a far cry from its $522 million valuation through Tuesday’s close.

©2022 Bloomberg L.P.