Feb 11, 2020

Bed Bath & Beyond plunges after disclosing more sales doldrums

, Bloomberg News

Elliott Fishman's Top Picks

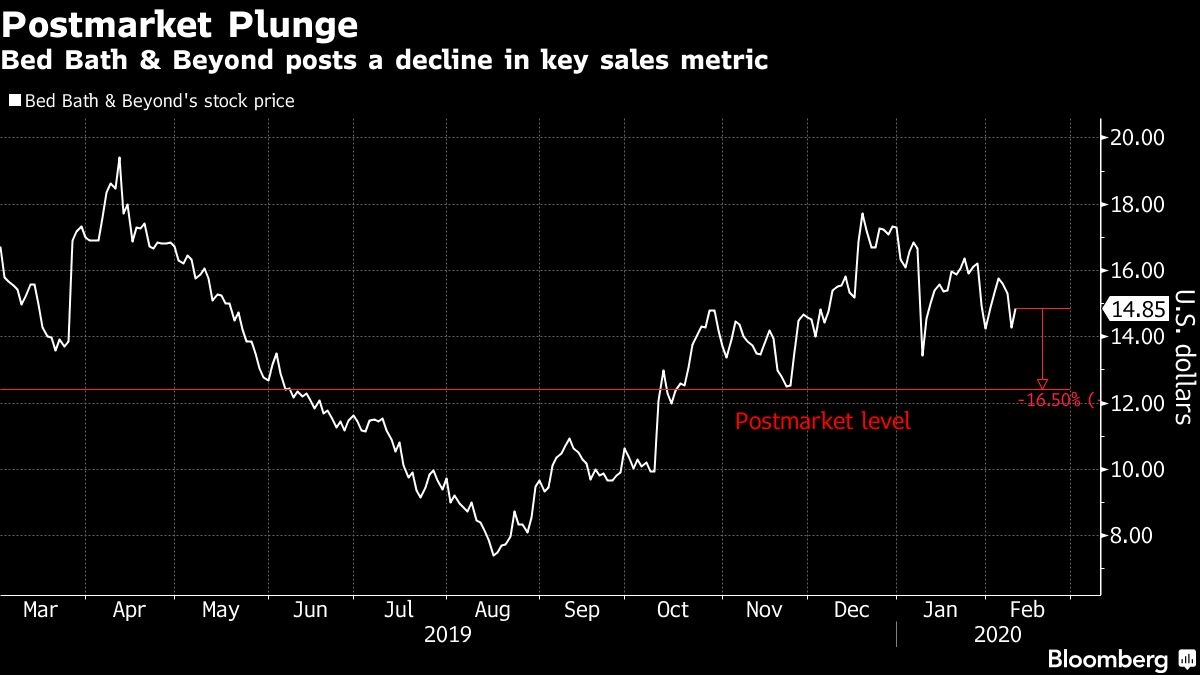

Bed Bath & Beyond Inc. fell sharply after reporting that a key measure of sales contracted in December and January, the latest sign the home-furnishings retailer faces a tough road back to growth.

“We are experiencing short-term pain in our efforts to stabilize the business, including the pressures of store traffic trends,” Chief Executive Officer Mark Tritton said in a statement.

Comparable-store sales, an important gauge of retail success, fell 5.4 per cent in the most recent months, the company said. It attributed this to lower store traffic and “inventory management issues.”

The stock plunged as much as 17 per cent to US$12.30 in late trading in New York. The shares have already fallen 14 per cent this year through Tuesday’s close.

Digital sales were a bright spot, growing about 20 per cent, Tritton said, calling it a “notable positive shift.”

“I believe we can solidify this growth, while also addressing the broader stabilization of our business,” he said.

Tritton, who came from Target Corp., has taken the reins at Bed Bath & Beyond following an extensive strategic review of the company’s operations and a management overhaul.

Tuesday’s update to results in the current quarter, which will conclude at the end of this month, shows that Tritton is still clearing the deck after years of declining and stagnant sales. It follows third-quarter results, released last month, that one analyst dubbed “much worse than expected.” Bed Bath & Beyond has struggled to draw shoppers amid a barrage of competition from online retailers, discounters and big-box stores.

In the quarterly call with investors, Tritton had flagged the company’s trouble with inventories, uncompetitive prices and a lack of convenience for digital-savvy shoppers.