Aug 24, 2022

Bed Bath & Beyond surges after report on financing deal

, Bloomberg News

Bed Bath & Beyond Inc. shares jumped 18 per cent on Wednesday after a report that the home goods retailer has selected a lender to provide financing as it seeks to boost liquidity.

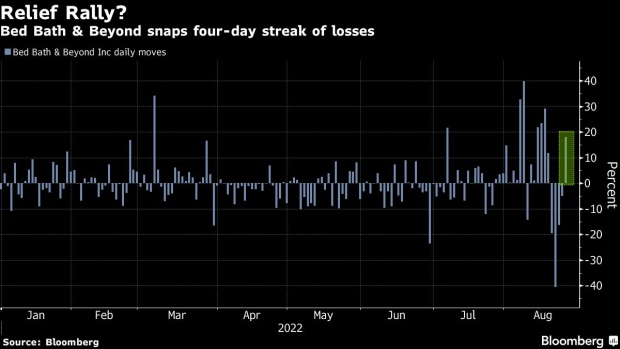

The company has picked a lending proposal after talks with investors for a new line of credit, Bloomberg reported, citing people with knowledge of the private discussions. Bed Bath & Beyond snapped a four-day losing streak that saw shares tumble more than 70 per cent from last week’s peak through Tuesday’s close.

Representatives for Bed Bath & Beyond and company advisers Kirkland & Ellis and Lazard didn’t immediately respond to requests for comment. The Wall Street Journal earlier reported that the company had reached a deal.

The retailer has previously said it is struggling with cash and inventory optimization, and ordering missteps appear to have left it with a glut of goods that will have to be sold at markdowns.

However, that didn’t deter individual investors from piling in. A favorite among retail traders, Bed Bath & Beyond surged more than 400 per cent from a July low to outperform other so-called meme stocks earlier this month.

The rally came to an abrupt halt following the disclosure by the company’s top investor Ryan Cohen that he was selling his stake in the retailer. Cohen went on to offload all his shares, triggering a record 45 per cent intraday tumble for the stock on Aug. 19 as he pocketed US$68.1 million in profits.