Jan 12, 2023

Bed Bath & Beyond triples as retail traders fuel latest burst

, Bloomberg News

Bed Bath & Beyond to cut jobs, close stores

Bed Bath & Beyond Inc. continued to surge on Thursday, rising for a fourth day and hitting the highest level since early November, after the company's bankruptcy warning reignited interest from retail traders.

Shares in the home-goods retailer climbed as much as 29 per cent, adding to 166 per cent gains from the previous three sessions. Other so-called meme stocks also added to gains Thursday after jumping Wednesday. Carvana Co. rallied 17 per cent while meme-stock poster-children AMC Entertainment Holdings Inc. and GameStop Corp. saw more modest gains.

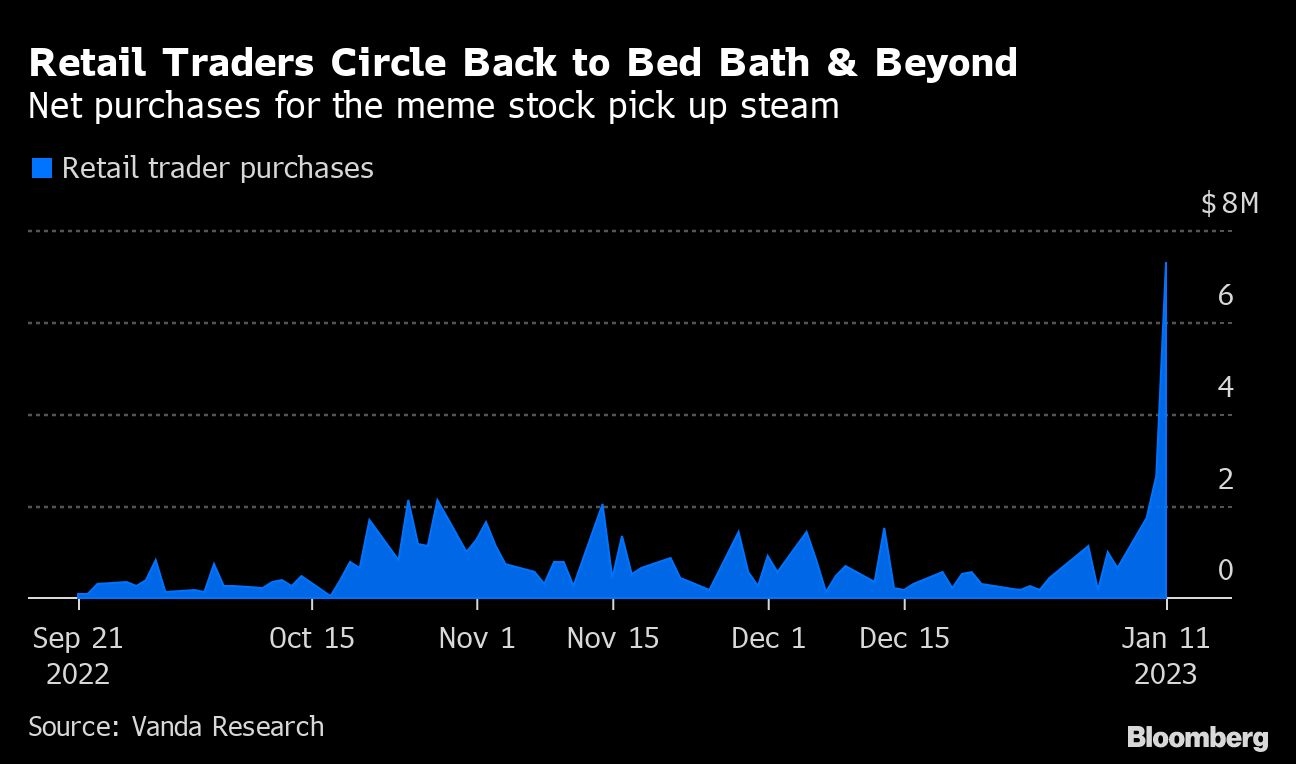

Retail traders have helped drive the latest surge, funneling millions into Bed Bath & Beyond and pumping their bets on social media websites and chatrooms. These investors snapped up US$7.3 million of Bed Bath & Beyond stock Wednesday to more than double their net purchases since the markets closed on Jan. 4, Vanda Research data show.

That buying continued Thursday with the stock seeing the second-most buy orders on Fidelity's platform, only lagging Tesla Inc., with purchases outpacing those to sell. Touts across platforms like Reddit's WallStreetBets and Stocktwits have accelerated in recent days alongside retail buying.

Volatility in Bed Bath & Beyond has soared since the company warned last week that it may need to file for bankruptcy. The stock's ten-day volatility hit the highest level in at least five years, surging past levels seen when meme-stock mania captivated investors in early 2021.

Back then, individual investors teamed up on social media with the goal of punishing short sellers while making a killing for themselves. That fueled eye-popping rallies in stocks such as Bed Bath & Beyond and GameStop. With Bed Bath & Beyond short interest rising to about 53 per cent from 47 per cent one month ago, according to data from analytics firm S3 Partners, there could be a further squeeze on the horizon.

“If bankruptcy is not in Bed Bath & Beyond's future, its rallying stock price will force a massive short squeeze and short sellers will rush to the doors and buy-to-cover in order to retain some of the mark-to-market profits they earned in 2022,” Ihor Dusaniwsky, head of predictive analytics at S3 Partners, wrote in a research note.

Bed Bath & Beyond tumbled 83 per cent in 2022 in its worst year on record, according to data compiled by Bloomberg going back to 1993.

The retailer has the second largest short interest as a percentage of float for stocks with over US$10 million of short interest, behind only Silvergate Capital Corp., Dusaniwsky said. But one key difference between Bed Bath & Beyond and other crowded shorts is the increasing likelihood of a bankruptcy filing.

“If the threat of bankruptcy becomes more of a certainty, the prospect of a Bed Bath & Beyond short squeeze becomes less and less, we can expect minimal short covering as short sellers wait for a US$0.00 stock price,” he wrote.

Despite the recent rally, Bed Bath & Beyond remains down more than 90 per cent from a peak of US$52.89 during the meme stock frenzy about two years ago.