Jul 29, 2021

Bentley’s 2021 Profits Already Exceed Those in Any Full Year

, Bloomberg News

(Bloomberg) -- Bentley Motors Ltd evaded semiconductor chip shortages, overcame factory closures, and streamlined production inefficiencies during the coronavirus pandemic so well that in the first six months of 2021, the company has already outperformed any full-year period in its 102-year history.

Profit levels for the first six months reached €178 million ($211 million), beating Bentley’s previous record for a full-year profit of €170 million, set in 2014. Bentley’s revenue for the first six months of 2021 was €1.32 billion, up from a pre-pandemic half-year figure of €834.8 million in 2019, reports the U.K.-based auto manufacturer.

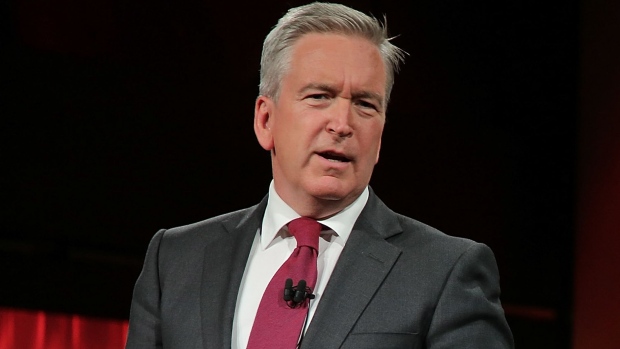

“We are benefitting from a sector growth that we thought would be about 25%, but it’s actually closer to 40% year on year,” Bentley Chairman and Chief Executive Officer Adrian Hallmark tells Bloomberg. “Each month we end up with more orders than we started with, despite the fact that we are up so much in sales rate. And it’s even getting stronger as we go through the year, so we are in a pretty good position.”

The news comes amid other wild successes for Bentley. Global retail sales for the first six months of 2021 increased by 50% over pre-Covid levels, up to 7,199 vehicles sold, compared with 4,785 sold in 2019. The brand will debut nine models this year, including two hybrids, the Bentayga Hybrid and Flying Spur Hybrid. Sales of pre-owned Bentleys are up 150% from January to May.

In an April report that noted extensive growth in sales at Bentley, Bloomberg Intelligence analyst Michael Dean called Bentley “the standout” among its luxury peers, including Porsche, Rolls-Royce, and Lamborghini.

The U.K. marque enjoyed “a record 2020 buoyed by a new Bentayga and Flying Spur, with both having four doors which are favored by wealthy Chinese buyers who often prefer being chauffeured,” Dean said.

In addition to the massive boom in the global luxury sector, Hallmark attributed the growth to intense internal restructuring within the brand. In June 2020, Bentley cut nearly 25% of its workforce.

“We made some tough decisions,” Hallmark says. “We cut our costs and our workforce—which we probably would have done over two or three years, because we knew we were top-heavy—but we had to do it decisively.”

Each of Bentley’s three model lines contributed to the massive surge. The Bentayga SUV sold 2,767; the two-door Continental GT sold 2,318; and the Flying Spur sedan sold 2,063. According to Hallmark, the market launch of the Flying Spur and its new V8 engine in China, Bentley’s biggest sales region, contributed to the model line’s share of 29% of global sales.

“The majority of [the success] is because of the product strength, the brand strength, the order bank, and the ability to deliver quality, quantity new cars on time,” Hallmark says.

The hybrids, in particular, will be critical to the brand’s continued success. They form the backbone of Bentley’s “Beyond100” plan to offer plug-in hybrid or electric vehicles by 2026 and exclusively electric vehicles by 2030.

Bentley parent company Volkswagen AG is betting big on electric power, allocating €73 billion—half its overall spending—for electrification and digital offerings from now to 2025. VW Group is currently the top EV maker in Europe after pooling resources and standardizing an EV platform that can work for multiple models across its dozen brands, including Audi, Bentley, Lamborghini, and Porsche.

Bentley is the golden child among them at the moment.

“We are lucky that the group is huge,” Hallmark says. “They buy them in bulk and because we are profitable, and we have a huge order bank. We get prioritized first, together with Lamborghini.”

Of the Bentayga SUVs sold last year—a group making up nearly half of all the Bentley vehicles sold worldwide—25% were hybrids, according to Bentley. Hallmark describes the demand for hybrids as an “unprecedented” opportunity.

©2021 Bloomberg L.P.