Apr 6, 2020

Berkshire Hathaway to Join Global Debt Bonanza

, Bloomberg News

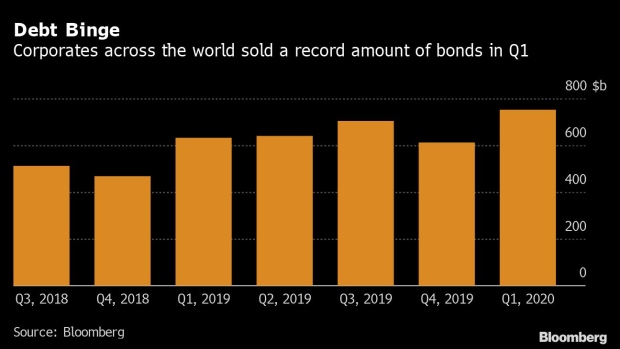

(Bloomberg) -- Warren Buffett’s conglomerate Berkshire Hathaway Inc. is joining a record bonanza of corporate debt sales, as companies around the world pay up to stockpile cash.

The U.S. company is marketing yen-denominated bonds in multiple parts. The 10-year tranche is being offered with a spread of 100-110 basis points. That compares with the 50 basis points it paid to price a similar-maturity note in September.

Borrowers have been undeterred by a spike in financing costs sparked by the coronavirus pandemic. Many are building cash buffers to tide them over as the pandemic makes global recession certain, and others are expanding reserves for acquisitions. Worldwide debt sales blasted past a record $200 billion last week, with Oracle Corp. pricing a $20 billion offering and T-Mobile US Inc. raising $19 billion to help finance the acquisition of Sprint Corp.

While Asia has continued to lag the global bond boom--with many borrowers in the region making do with bank loans and local-currency note markets--more have emerged in recent days. Indonesia was marketing U.S. currency debt on Monday, as was Mitsubishi UFJ Lease & Finance Co.

Asia

- Berkshire Hathaway is marketing yen notes across tenors from three years to 40 years. In September, it priced a 430 billion yen (about $4 billion) six-part bond offering that was the biggest yen note offering by a non-Japanese borrower and the first in the currency from the company

- The offering could be welcome news for institutional investors in Japan desperate for yield and safer credits. The country’s Government Pension Investment Fund said last week it will allocate 25% of its assets into overseas debt while cutting holdings of Japanese bonds. Read more about that here

- Republic of Indonesia is offering a three-part note sale and will use the proceeds in part to fund its Covid-19 relief and recovery efforts

- Credit markets along with other risk assets were calmer Monday after the daily reported death tolls in some of the world’s coronavirus epicenters dropped on Sunday

- The Markit iTraxx Asia ex-Japan index of credit-default swaps declined about 3 basis points Monday, according to traders. It widened about 21 basis points for the week

- Spreads on Asian investment-grade dollar bonds were little changed, traders said. They widened for a seventh straight week through Friday, the longest such streak in more than a year, according to a Bloomberg Barclays index

- Trading volumes were light and liquidity in the market still appears thin

Europe

- The frenetic pace of issuance continued Friday, with seven deals adding to last week’s tally

- The euro-area economy is going through a sharp slump as lockdowns to contain the spread of the coronavirus are extended. Italy announced its lowest-ever services PMI reading, while U.K. services industries shrank at the fastest pace in at least two decades

- The Bank of England pledged to be more aggressive with a new round of bond purchases

U.S.

- Friday was fairly quiet following a grim payrolls report

- FedEx, MetLife and Dell were set to push last week’s record high-grade issuance even higher

- Citigroup made more than $100 million trading a huge swath of AAA CLOs as market turmoil prompted asset managers in need of liquidity to unload securities at steep discounts

- For more, click here for the Credit Daybook Americas

©2020 Bloomberg L.P.