It was a year many of us were hoping would return to some semblance of “normal” - but, much like 2020, it was anything but.

While businesses were still dealing with aspects of COVID-19, like restrictions, the pandemic brought a whole new set of challenges such as labour shortages and supply chain bottlenecks.

Meanwhile, stocks were sent to new all-time highs, until the prospect of more aggressive stimulus withdrawal was put firmly on the table by central banks.

Throw in out-of-control inflation and you get a very complicated 2021.

Here are the top news stories of this year.

8.BRIDGING FINANCE UNRAVELS

It started with a news release on the morning of Saturday, May 1, when the Ontario Securities Commission (the OSC) announced Bridging Finance Inc. had been rushed into receivership at the regulator’s behest.

The OSC sought the Ontario Superior Court of Justice’s intervention as its staff alleged the private lender misappropriated funds and claimed other questionable transactions, including $19.5 million in undisclosed payments allegedly sent by a key intermediary directly into the bank account of Bridging Finance Chief Executive Officer David Sharpe.

In the months that followed, new allegations and findings raised alarms about what transpired at Bridging, and the court-appointed receiver fired Sharpe, who has cried foul over the OSC staff’s handling of its probe.

While none of the allegations against Bridging or Sharpe have been tested or proven, the real losers in this situation will likely be the firm’s roughly 26,000 investors, many of them mom and pop investors, who put money in the firm’s funds.

Pricewaterhousecoopers Inc. (PwC), which inherited responsibility for Bridging in the spring, estimates losses attributed to the unitholders could be a minimum of $580 million.

7.TSX'S RECORD-BREAKING RALLY

What a year for Canadian investors. The S&P/TSX Composite rose to new heights, setting a new record in mid-November, as the index shrugged off the lingering pandemic.

A heavyweight subgroup – the energy sector -- has been the strongest performer for the Canadian benchmark this year as oil prices soared and energy companies doled out dividend hikes and share buyback programs.

The financial subgroup was the second-best performer and the red-hot warehouse and residential markets helped lift real estate stocks. As of Dec. 20, only the materials subgroup and health care (which mainly consists of cannabis companies) were negative for the year.

It’s unclear though whether the record-breaking rally will continue into next year, as the Bank of Canada gets set to begin what could be an aggressive interest rate hiking campaign.

6.CANADA'S JOBS RECOVERY

The word “resilient” has been used time and time again to describe Canada's labour market throughout the pandemic.

In April 2020, Statistics Canada reported the economy had lost around three million jobs because of widespread shutdowns -- but by September this year, roughly all of those jobs had been recovered.

Currently, employment levels have exceeded pre-COVID levels, despite continued waves of restrictions. Statistics Canada said this labour market rebound has been stronger than in the two previous economic downturns.

5.LIBERALS SPEND, SPEND, SPEND

$101 billion. That was the number that captured headlines after the federal Liberals unveiled a budget in April that aimed to spend that amount over the next three years to help the economy dig out of the pandemic.

The Liberals touted it as necessary and said the additional debt burden would be manageable because of low interest rates. The government also assured “fiscal guardrails” would be used to ensure the debt doesn’t get out of hand.

Critics quickly piled on, saying the massive spending plan went too far when the economy and labour market were showing signs of a faster-than-expected recovery.

In December’s fiscal update, the Trudeau government predicted the federal debt-to-GDP ratio would peak this year at 48.0 per cent before declining to an estimated 44.0 per cent in fiscal 2026-27.

4.ENERGY SECTOR GETS ITS MOJO BACK

After years of being beaten down and abandoned by investors big and small, Canada’s energy sector got its time in the limelight again, for the right reasons.

Not only is oil gushing from Canadian energy companies, but now, cash is too.

Canadian energy companies have spent the past several years streamlining their operations and paying down debt after suffering through multiple commodity price collapses, so when oil prices surged this year, it provided a one-two punch punch that boosted many firms’ free cash flow.

Many companies have since rewarded shareholders with dividend hikes and planned share buyback programs, once again cementing their place in many investors’ portfolios.

All of these tailwinds helped crown the energy sector as the TSX’s best performing subgroup and helped propel the broader index to a new record.

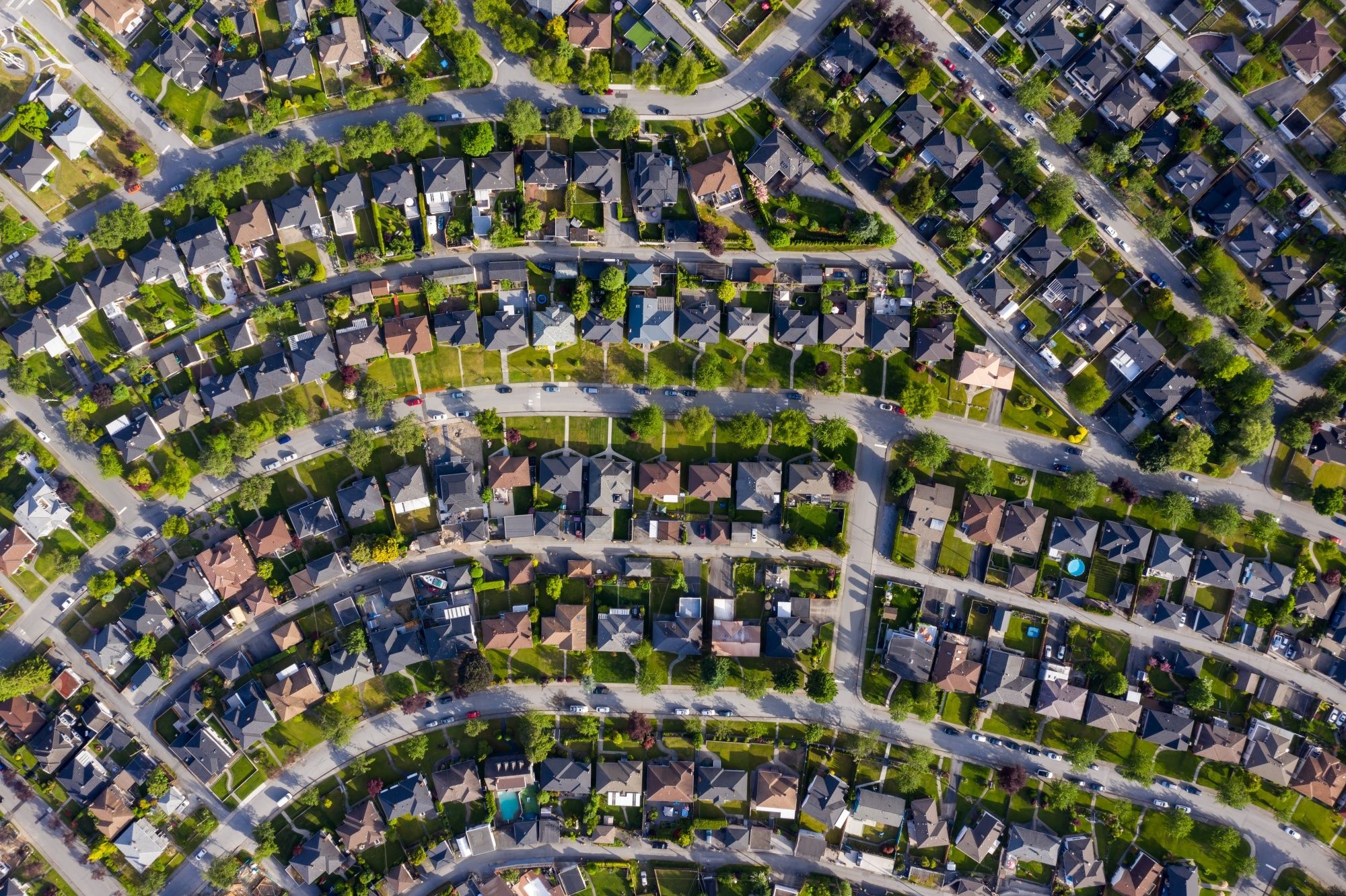

3.HOUSING ON FIRE

What to do about the housing market. The affordability situation went from bad to worse for homebuyers in 2021.

In fact, RBC Economics said in a Dec. 20 note that the overall cost to carry a home rose to nearly 50 per cent of the average household income in the third quarter. That number is even higher in markets like Vancouver and Toronto

Skyrocketing home prices are also no longer reserved for the country's big cities - demand for homes in rural areas continued to intensify, driven in part by low interest rates and the ability to work remotely.

While many housing experts have called for more supply, policymakers are still looking mainly at demand-side measures, such as tougher non-resident buyers taxes in Ontario.

RBC had a word to describe the outlook for buyers: “Grim.”

2.INFLATION SPIKES

It's become a part of life that no one can escape. From household budgets to corporate balance sheets, everyone has felt the effects of rising consumer prices.

Inflation has accelerated to a pace not seen in nearly two decades. Some businesses -- such as energy producers -- have a much easier time passing on higher costs to consumers, while other companies can not -- like retailers that compete directly with Amazon.

It put Bank of Canada Governor Tiff Macklem in arguably the toughest spot of all. The central bank's main mandate is to maintain inflation around two per cent, but many economists point to global supply chain disruptions as the main reason prices are soaring -- rendering interest rate hikes essentially useless in tamping down inflation.

1.ROGERS POWER STRUGGLE

It's not often you see a dramatic power struggle play out in the public eye in Corporate Canada. But that's exactly what happened at Rogers Communications Inc.

Chair Edward Rogers battled his mother and two sisters for control of the telecom giant after his plan to replace Chief Executive Officer Joe Natale was initially foiled.

The fight moved from the boardroom to the courtroom, where Mr. Rogers, and the shadow board of directors he formed, were confirmed as the company's legitimate senior governance team. He subsequently prevailed in bringing back Tony Staffieri, the company’s former chief financial officer, as its new chief executive.

The turmoil played out at a critical juncture in Rogers’ history as it attempts to win regulatory approval for its most important acquisition to date: the planned $20-billion takeover of Shaw Communications Inc.