May 16, 2019

Best Way to Win the Commodity Trade War Is by Sitting It Out

, Bloomberg News

(Bloomberg) -- As the U.S. and China hit each other with commodity tariffs, other nations are reaping the benefits -- at least for now.

From Saudi Arabia to Brazil and Qatar to South Korea, nations that are major sellers and buyers of various raw materials are being given an unintentional helping hand by the battle between the world’s top-two economies. Tariffs are squeezing flows of commodities such as soybeans and natural gas between the U.S. and China, creating opportunities to fill the gap. All parties could end up losing in the long run, though, if the dispute drags on and crushes demand.

In the U.S., farmers face more pain with the prospect of millions of tons of soybean supplies being shunned by China. Fears are also rising that Brazil will take a bigger piece of the cotton-market pie at America’s expense. Energy projects may lose out on billions of dollars in funding without supply contracts, and manufacturing is weakening as tariffs raise import costs. All that’s threatening the healthy economic growth touted by President Donald Trump.

For China -- the world’s biggest consumer of energy, metals and grains -- the trade war curbs its access to a burgeoning natural gas and oil supplier that could shield against geopolitical risks and unexpected supply disruptions. The country is also facing higher import costs at a time when inflation may accelerate because of a deadly pig virus, hurting an already vulnerable economy and putting pressure on policy makers to boost stimulus.

“I really think both parties badly need and badly want a resolution to the trade war,” Joe Sanderson, the chief executive officer of U.S. chicken producer Sanderson Farms Inc., said in an interview on Wednesday. He flagged how America’s tariffs on steel and aluminum imports have increased costs as the company plans to build a new processing plant.

In the politically sensitive agricultural front, Brazil may continue to take more market share of cotton shipments to China. That’s the fear of the U.S. industry, which was hoping for a resolution to the trade war and increased exports to the Asian nation, according to the National Cotton Council of America.

China has already canceled a purchase of American pork and bought only limited amounts of soybean, cotton and sorghum last week, according to U.S. Department of Agriculture data.

What’s more, soybeans premiums in Brazil, the world’s top exporter, are soaring on speculation that its cargoes could replace those from America. European buyers, in turn, would get access to cheaper U.S. supply.

For natural gas, the trade war has soured chances for a partnership between a burgeoning exporter and the fastest-growing consumer of the fuel. Instead, American LNG carries a 25% tariff that can make it more expensive than competitors, and threaten the viability of U.S. export projects. That could help rival LNG facilities in Qatar, Russia, Canada and Africa.

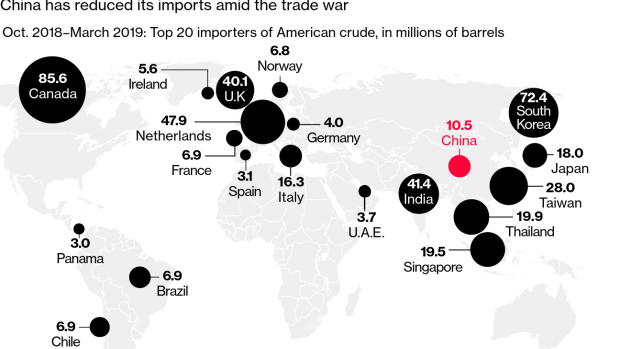

And even though oil has been left off the list of tariffs so far, Middle East crude producers are raising the pricing for their supply to the highest level in years, as U.S. sanctions on Iran and Venezuela exacerbate a market squeeze. Meanwhile, Chinese refiners are shunning American supplies to avoid political risk and buyers in nations such as South Korea and Thailand face less competition for U.S. cargoes as they prepare for peak fuel demand in summer.

While other nations may be able to take advantage of the trade war, there’s a looming risk that an extended fight between the two global powers will do significant damage to the world economy. That would weaken consumption of all most commodities and undo any short-term benefits. Morgan Stanley, which expects the two nations will reach a deal, has warned of a global recession -- growth below 2.5% by 2020 -- if the two sides remain at odds.

Corporate confidence would suffer if trade tensions persist, Chetan Ahya, Morgan Stanley’s chief economist, said in a report. “As the damage to corporate confidence lingers, spending fails to pick up, and a negative feedback loop of weaker global growth and tighter financial conditions could unfold,” he wrote.

Goldman Sachs Group Inc. expects the U.S. and China will strike a deal later this year, in which case market sentiment is likely to recover quickly. However, the bank sees a 30% probability of the spat escalating, which would lead to an additional selloff in risk assets.

The concern was echoed by the chief executive officer of agribusiness giant Archer-Daniels-Midland Co. The longer it takes for the trade war to be resolved, the bigger the risk that 2019 earnings won’t beat last year’s, Juan Luciano said at a BMO conference in New York on Wednesday.

--With assistance from Shruti Date Singh, Sheela Tobben, Christine Buurma, Sharon Cho, Serene Cheong and Mario Parker.

To contact the reporters on this story: Pratish Narayanan in New York at pnarayanan9@bloomberg.net;Isis Almeida in Chicago at ialmeida3@bloomberg.net

To contact the editors responsible for this story: Tina Davis at tinadavis@bloomberg.net, Patrick McKiernan

©2019 Bloomberg L.P.