(Bloomberg) -- Investors betting against Treasuries -- or even just hiding out in cash waiting for lower prices -- just suffered a rough week, even after a robust slate of economic figures showed the rebound from the pandemic is gaining steam.

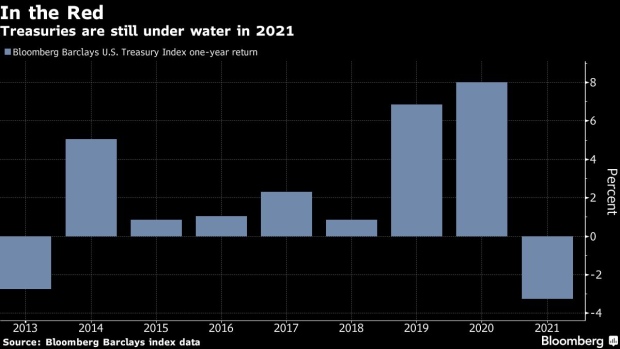

The debate over the long-term outlook for the $21 trillion market is far from over. The bearish view has dominated in 2021, but it was just dealt a blow as Treasuries posted their biggest weekly rally since August. And some strategists see potential for yields to stage a brief foray to even lower levels.

Ten-year yields tumbled to just above 1.5% Thursday, a stunning turnaround after the specter of a 2% breach swirled just a few weeks ago. The bond rally gained speed as evidence of robust international demand spurred some investors to exit short bets, a move that seemed to defy logic as it came amid an array of strong economic data.

It doesn’t look like there’s much help straight ahead for the bears, with next week devoid of major data releases, Federal Reserve officials muzzled before their April 28 decision and geopolitical tensions brewing. What’s more, the fate of the next U.S. spending plan -- which may include a chunk of taxes -- is unclear, and the reopening push took a hit as regulators paused Johnson & Johnson’s Covid-19 vaccine rollout.

“Lower yields, or even just no further pickup, seems to be the pain trade now,” said Chris Ahrens, a strategist at Stifel Nicolaus & Co. “A lot of financial institutions are very flush with cash and had been holding on and hoping for higher yields -- cheaper prices -- to come back into the Treasury market. Now they are being forced to buy Treasuries at higher prices.”

After the worst quarter since 1980, the Treasuries market has gained around 1% this month, paring its 2021 loss to about 3.3%, according to Bloomberg Barclays index data through April 15.

The 10-year note yields 1.58%, down about 20 basis points from the more than one-year high reached at the end of March. Hedge funds had been massive sellers of Treasuries since the start of January. With stocks surging of late, retail buyers have also been biased against bonds, pouring more cash into equity funds.

Bullish Tone

But now there’s a bullish tone emerging in parts of the rate market, with demand surfacing for options targeting a drop in 5-year Treasury yields to as low as 0.55% ahead of their May expiry, and for the 30-year yield to sink to 2.1%. Those maturities yield 0.83% and 2.26%, respectively.

Treasury yields could extend their decline, potentially taking the 10-year yield as low as 1.2% -- a level not seen since February, says Tom Essaye, a former Merrill Lynch trader who founded “The Sevens Report” newsletter.

“The market is ignoring really good economic data now, so the thing that is going to get yields moving higher again is either a surprise pop in inflation or a bit of a hawkish turn in tone from the Fed,” he said by phone. “I don’t see either of those things happening in the very short-term. Longer-term, I still think yields are headed higher -- but we are in this weird position now where the Fed has essentially said they aren’t changing their opinion of things no matter what the data is.”

Fed Chair Jerome Powell has said that while the economy appears to have turned a corner, central bankers aren’t in a hurry to remove monetary support. BlackRock Inc. the world’s biggest asset manager, is among those predicting the Fed will begin communicating plans to taper its bond buying in June.

Granted, the bears can take solace in views that surfaced at the end of the week, suggesting it’s time to get short again. Mark Cabana, head of U.S. interest rates strategy at Bank of America Corp., said on Bloomberg TV on Friday that he’s been encouraging clients to use the “little rate rally” to reset short positions.

The median forecast in a Bloomberg survey is for the 10-year yield to end the year at 1.86%.

What to Watch

The economic calendar:

- April 21: MBA mortgage applications

- April 22: Chicago Fed national activity index; jobless claims; Langer consumer comfort; leading index; existing home sales; Kansas City Fed manufacturing activity

- April 23: Markit U.S. PMIs; new home sales

- The Fed calendar is empty ahead of the April 27-28 policy meeting

The auction calendar:

- April 19: 13-, 26-week bills

- April 20: 52-week bills

- April 21: 20-year reopening

- April 22: 4-, 8-week bills; 5-year TIPS

©2021 Bloomberg L.P.