Oct 6, 2020

Biden election basket rallies after Trump nixes stimulus talks

, Bloomberg News

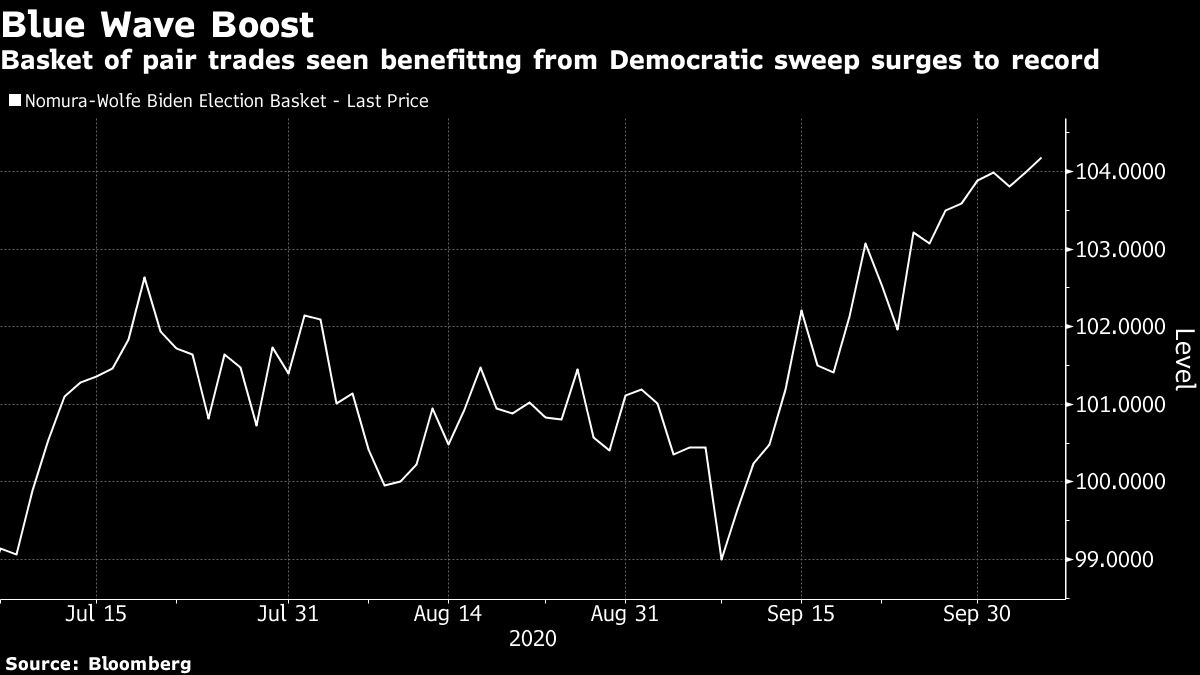

Blue wave boost: Assets expected to do well with Biden win

President Donald Trump’s sudden halt to stimulus talks coincided with a surge in a group of stocks seen as benefiting the most from a Joe Biden presidency.

The Nomura-Wolfe Biden Election Basket, which bets on potential winners from Democrats taking control in Washington while wagering against losers, jumped to a record high while the S&P 500 Index plunged after Trump said he told his negotiators to stop talks on a fiscal stimulus package.

The basket consists of 30 pair trades across sectors. While such baskets are far from scientific exercises and could reflect biases in their creators or market signals that have nothing to do with the election, the idea is that investors can buy if they believe Biden is headed for the White House and short it if they believe Trump will win re-election.

Some analysts who’ve watched Biden’s lead in the polls swell in recent days are now speculating that Trump’s walking away from talks will add to former vice president’s lead and potentially deliver Democrats both houses of congress. The party has made little secret that it backs a spending bill even larger than the US$2.2 trillion package it has currently offered, and a broad victory could see Democrats revert to the May House bill that sought more than US$3 trillion.

“It will now come down to who sweeps and how much stimulus we get,” said Dennis DeBusschere, head of portfolio strategy at Evercore ISI. For now, “the sweep scenario clearly favors the Dems.”

With less than a month to the election, a victory by Biden amid a Democratic sweep of Congress has quickly become a scenario that investors are trying to handicap. While some analysts say the party’s proposed tax hikes may hurt corporate profits, others are focusing on the potential benefit from their agenda, such as a boost in fiscal stimulus.

The Invesco Solar ETF, ticker TAN, jumped 14 per cent over the past week amid optimism over a potential increase in infrastructure and green-energy spending.

“We’ll see who voters/markets blame for the breakdown, but it would seem like Trump is taking some personal responsibility for the impasse,” said Sameer Samana, Wells Fargo Investment’s senior global market strategist. “Taken alongside the events of the past week, it probably does nothing to take negative attention off of him.”

The Nomura-Wolfe Biden basket employs several strategies across sectors including:

- Technology

- Long onshoring of semiconductor production, short higher corporate tax rates.

- Health care:

- Long labs and research, short managed care.

- Utilities

- Long “green” such as clean energy and renewables, short pipelines.

- Consumer Discretionary

- Long electrification, short auto dealers

- Long gaming, short cable.

- Consumer Staples

- Long high international sales, short high U.S. sales.

- Financials:

- Long regional banks, short money center banks.

- Long insurance, short subprime.