Sep 13, 2022

Biden Officials Weigh Buying Oil at Around $80 to Refill Reserves

, Bloomberg News

(Bloomberg) -- The US may begin refilling its emergency oil reserve when crude prices dip below $80 a barrel, according to people familiar with the matter.

Biden administration officials are weighing the timing of such a move, with an eye toward protecting US oil-production growth and preventing crude prices from plummeting, said the people, who asked not to be named sharing internal deliberations.

The discussions come as West Texas Intermediate, the U.S. benchmark, plunged to almost $81 a barrel last week, its lowest level since January. While President Joe Biden in March ordered the release of an historic 180 million barrels from the Strategic Petroleum Reserve -- an effort to tame skyrocketing oil and gas prices -- officials are now aiming to slow those releases to keep the market in check heading into the winter.

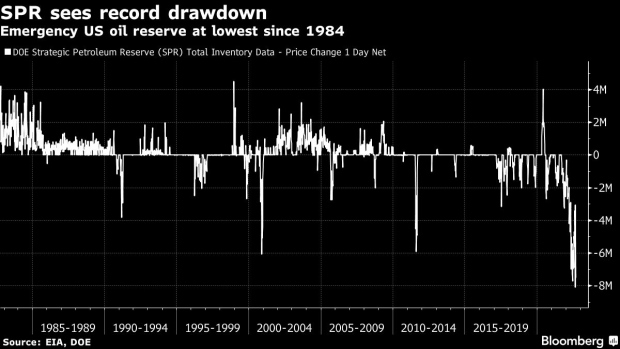

At the same time, officials are trying to reassure oil producers that the administration won’t let prices collapse amid intense volatility that’s fueled massive daily swings. Buying crude to refill the reserve, which is now at the lowest level since 1984 after a record drawdown last week, would be supportive for the market.

WTI pared losses to trade near $87 a barrel on the news on Tuesday.

White House and Energy Department communication staff didn’t immediately respond to requests for comment.

(Adds chart and details on SPR level in fourth paragraph, oil price in fifth and DOE comment in last.)

©2022 Bloomberg L.P.