Apr 20, 2021

Biden Spending Plan Seen Jolting Muni Green-Bond Sales to Record

, Bloomberg News

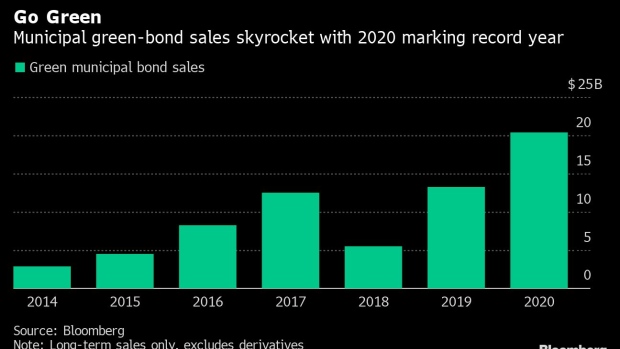

(Bloomberg) -- The municipal debt market may be headed for a second straight year of unprecedented green-bond issuance, in a boon for asset managers keen on deploying cash to such investments.

That’s the view of Lauren Kashmanian at Parametric Portfolio Associates LLC as she analyzes the potential of President Joe Biden’s $2.25 trillion spending plan. The proposal includes money for mass transit, green housing development, electric-vehicle charging infrastructure and strengthened water systems and electric grids.

The funds for such projects have often come from debt sold in the $3.9 trillion municipal market, where states and localities raise money for roads, schools and affordable housing. Deliberations over the president’s plan continue in Washington. But Kashmanian forecasts 2021 muni green-bond sales rising to a range of $30 billion to $35 billion, spurred in part by the conversation around the infrastructure proposal. Last year, issuers brought a record of roughly $20 billion of designated green bonds to market, data compiled by Bloomberg show.

“These projects that are outlined in the infrastructure bill -- public transportation, clean water projects, green building projects -- these have been traditionally financed through the muni market, and we expect a portion of those proposed initiatives will be financed through the muni market as well,” Kashmanian, a senior portfolio manager, said in an interview.

At about $3.5 billion for the first four months of 2021, the pace of muni green-bond sales is slightly ahead of the year-earlier clip, Bloomberg data show. A renewed surge would be good news for environmentally conscious investors. More investors are demanding debt with “green” or “social” designations, industry leaders said at a conference last month.

Fielding Calls

Kashmanian says she’s fielding an increasing amount of calls from individuals looking to make an impact with their investments, some of whom aren’t traditional muni purchasers. The buyers like hearing about the different projects that munis fund, like replacing lead pipes to insure clean drinking water, and schools that switch to solar panels, she said.

“Its an area that is growing in interest,” she said. “These investors didn’t realize they could get renewable energy projects in an investment grade bond.”

And it’s not just the federal government that could propel the next leg in the boom.

In New York, Governor Andrew Cuomo has placed a $3 billion environmental bond act on the ballot in November 2022, while in next year’s budget Florida Governor Ron DeSantis has proposed a bond-financed fund that would provide grants to local governments to finance projects focused on solving needs related to climate change.

Investors, rating companies and analysts have been paying closer attention to the risks that climate change holds for municipal credits, where securities may not mature for decades.

Related: Texas Freeze Strands Municipalities With Sky-High Power Tabs

Eve Lando, a portfolio manager at Thornburg Investment Management, says the cost of storms like the freeze that gripped Texas, coastal hurricanes or California wildfires tops the list of her worries when it comes to the municipal market.

“It has became apparent how expensive it is to manage weather-related volatility,” she said in an interview. “Long-term, I am worried as a bondholder, what will happen if we have 10 Texas’s at the same time.”

©2021 Bloomberg L.P.