Jun 21, 2022

Big Banks Led by JPMorgan Set to Return $80 Billion to Investors

, Bloomberg News

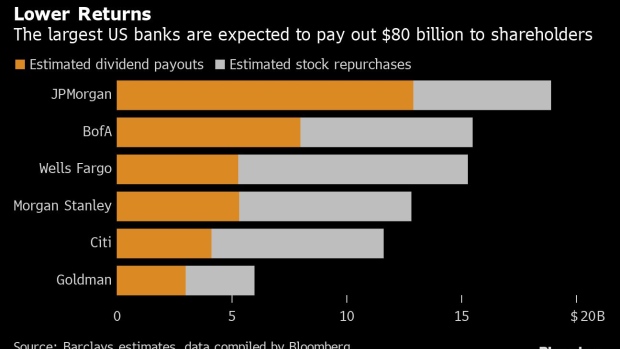

(Bloomberg) -- US banking giants are poised to return $80 billion to shareholders after this year’s Federal Reserve stress tests, less than last year’s elevated level that followed a pandemic-driven buyback pause.

JPMorgan Chase & Co. is set to lead the group with $18.9 billion in combined dividends and share buybacks, even as the biggest US lender spends more this year to build out offerings and fend off competition. Bank of America Corp. and Wells Fargo & Co. are expected to return $15.5 billion and $15.3 billion, respectively, according to data compiled by Bloomberg based on estimates provided by analysts at Barclays Plc.

“Because the banks didn’t buy back stock during Covid, the last year was very elevated, so you reduced that excess capital,” Jason Goldberg, an analyst at Barclays, said in an interview. “We’re certainly in a period of increased economic uncertainty, and at the same time we’re actually seeing pretty good loan-growth opportunities.”

The annual exams force banks to consider a hypothetical crisis and estimate the losses they might face based on their books of business. The banks use those numbers to assess how much capital they can afford to dole out to investors. The results of this year’s tests will be released Thursday, while banks will unveil their capital plans in the coming weeks.

Last year, dividend payouts by the nation’s six largest lenders rose by almost half after the country’s largest banks amassed mountains of excess cash during the pandemic. Morgan Stanley alone doubled its quarterly payout while also announcing as much as $12 billion in stock buybacks.

That makes for a tough comparison this year. Banks are also dealing with fears that historic levels of inflation and central banks’ efforts to tame it will limit economic growth. That’s been compounded by Russia’s invasion of Ukraine, which has sparked geopolitical uncertainty across the globe.

“Going forward this year, like many of our peers, we do expect to have a moderated share-buyback program due to the uncertainties of the macro environment,” Citigroup Inc. Chief Executive Officer Jane Fraser told investors in April.

This Fed’s “severely adverse scenario” this year includes “a severe global recession accompanied by a period of heightened stress in commercial real estate and corporate debt markets,” according to the Fed’s website. In a sign of the pandemic’s impact, the hypothetical downturn “is amplified by the prolonged continuation of remote work, which leads to larger commercial real estate price declines that, in turn, spill over to the corporate sector and affect investor sentiment.”

The scenario features a peak US unemployment rate of 10%, a real gross domestic product decline of 3.5% from the end of last year and a 55% drop in equity prices. It also incorporates a sharp decline in inflation to an annual rate of 1.25% in the third quarter of 2022 on higher unemployment and lower demand.

Historically, these exams would prompt frustration and anxiety across Wall Street and the Fed would ultimately have to sign off on lenders’ capital plans. Now, the vast majority of banks pass after having become more familiar with the exercises and no longer need Fed approval as long as they stay above their established capital minimums.

“There may be more stress, but there ought to be ample excess capital to render this manageable, broadly and in the context of our expected payouts,” Credit Suisse Group AG analyst Susan Katzke wrote in a note to clients, adding that incremental stress is being driven by balance-sheet growth and less money set aside for soured loans compared to last year.

©2022 Bloomberg L.P.