May 19, 2019

Big Banks Surge in Australia on Morrison's Shock Election Win

, Bloomberg News

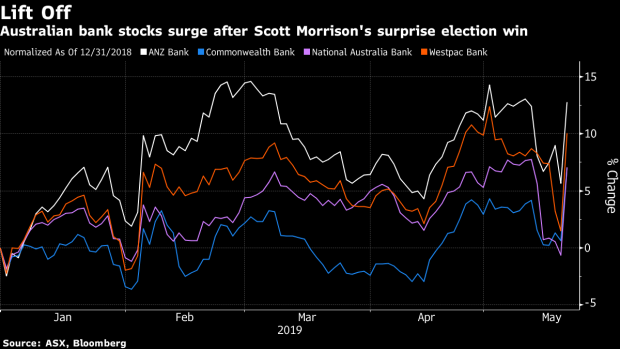

(Bloomberg) -- Shares of Australia’s big four banks surged in Sydney trading, after Scott Morrison’s center-right government pulled off a shock election win, killing opposition plans to wind back tax breaks for property and stock market investors.

Westpac Banking Corp. led the gains, rising as much as 8.8%, the biggest intraday rally in almost seven years. National Australia Bank Group Ltd. jumped 7.7%, Australia & New Zealand Banking Group Ltd. gained 7.2% and Commonwealth Bank of Australia rose as much as 6.2%.

The opposition Labor party, which was favored to win the election, had proposed reducing tax breaks for property investors, which could have slowed demand for home loans. It also planned to abolish some tax refunds from stock dividends, which may have reduced demand for bank shares that offer some of the highest, most reliable payouts.

“We believe the election result reduces tail risks in relation to credit quality, the mortgage market and the regulatory environment,” Morgan Stanley analysts wrote in a May 19 note. They lifted their price targets for the big four banks by an average 2.5%.

To contact the reporter on this story: Peter Vercoe in Sydney at pvercoe@bloomberg.net

To contact the editor responsible for this story: Edward Johnson at ejohnson28@bloomberg.net

©2019 Bloomberg L.P.