Mar 2, 2023

Big Food Brands Struggling to Kick Junk Addiction, Survey Finds

, Bloomberg News

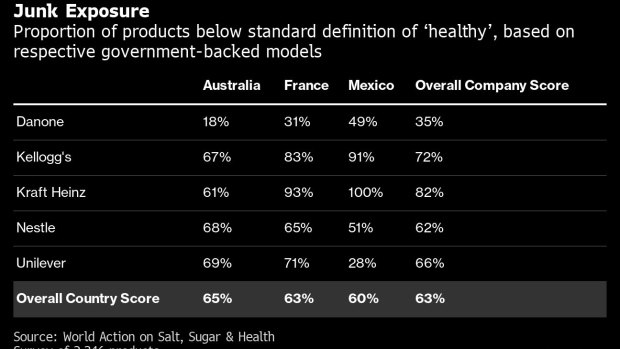

(Bloomberg) -- The bulk of food and drinks sold by four out of five global producers across three major markets are unhealthy, according to a survey, with Kraft Heinz Co. faring the worst.

The analysis conducted by the World Action on Salt, Sugar & Health, an NGO, selected 2,346 products sold by Danone, Kellogg Co., Kraft Heinz, Nestlé SA and Unilever Plc in Australia, France and Mexico. It ranked them on the basis of the most widely used standards — Health Star Rating, Nutri-Score and Warning Labels. Apart from Danone, all others sold a greater proportion of unhealthy food.

“Improving the nutritional content of food and drink by reformulating recipes with less salt, sugar and saturated fat is by far the most important strategy that any company should make to improve public health,” Mhairi Brown, policy and public affairs lead with WASSH, said in a statement. “However, by relying solely on industry’s willingness and without government enforcement, we are unlikely to see a meaningful shift.”

Producers are under pressure to make their portfolios healthier because obesity is already a public health crisis in countries like the US, and on the rise in the developing world. The worldwide economic impact of excess body weight will more than double to $4.27 trillion in 2035 from 2020 levels as prevalence of the condition continues to rise, according to a report funded by pharmaceutical company Novo Nordisk. It sell anti-obesity drug Wegovy.

Reducing the salt and sugar content of their foods could also insulate company revenues from laws restricting the sale and marketing of junk food. A greater emphasis on environmental, social and governance among investors is an added motivation for making portfolios healthier.

Four-fifths of Kraft Heinz products didn’t meet health standards across the three markets, with its entire sample in Mexico failing to make the grade. Some 72% of the products surveyed that were made by Kellogg’s didn’t meet the health criteria. The Crunchy Nut Cheerios maker last year failed to legally challenge regulations that would ban it from advertising its sugary cereals in the UK.

Activia yogurt maker Danone bucked the trend. Only 35% of products scored below the standard definitions of healthy. Earlier this week, it promised that at least 90% of products by volume of sales in the UK and Ireland will not be high in sugar, salt or fat, as defined by the government policy.

A Unilever spokesperson said the company is committed to giving consumers healthier choices and termed the findings of the survey incomplete and misleading as they were based on a small subset of their portfolio. Kraft Heinz is committed to reducing sugar and salt in its products, while noting that there isn’t a globally aligned model yet for judging how healthy food items are, according to its spokesperson.

Kellogg spokesperson Kris Bahner said the cereal maker was continuing to make its portfolio more nutritious. A Nestle spokesperson declined to comment.

Obesity Is Stalking Poor Countries, Where Hunger Once Reigned

The selection of products was based on the lines mentioned on companies’ country websites and major retailers, the report said.

Groups like ShareAction, an investor campaign group which supported the research, have been calling on companies to be more transparent about the healthiness of their portfolios to help investors scrutinize their offerings and evaluate the threat of potential anti-junk-food legislation on sales.

Danone and Unilever report on their portfolios content according to government-approved nutrition models while Nestlé committed to the same in its 2022 annual report, but the others are yet to follow suit, making it harder to get a full picture for comparison.

“Food manufacturers must be more transparent and disclose what proportion of their sales can be classed as ‘healthier’,” Holly Gabriel, a campaigner at ShareAction said. “This disclosure must be followed with meaningful targets to grow the proportion of sales coming from healthier food and drink.”

--With assistance from Deena Shanker.

(Updates with Kellogg comment in ninth paragraph)

©2023 Bloomberg L.P.