Dec 20, 2022

Big oil stages a big comeback as Exxon's valuation passes Tesla

, Bloomberg News

Even as energy names reach record highs, there is still opportunity to enter the market: Strategist

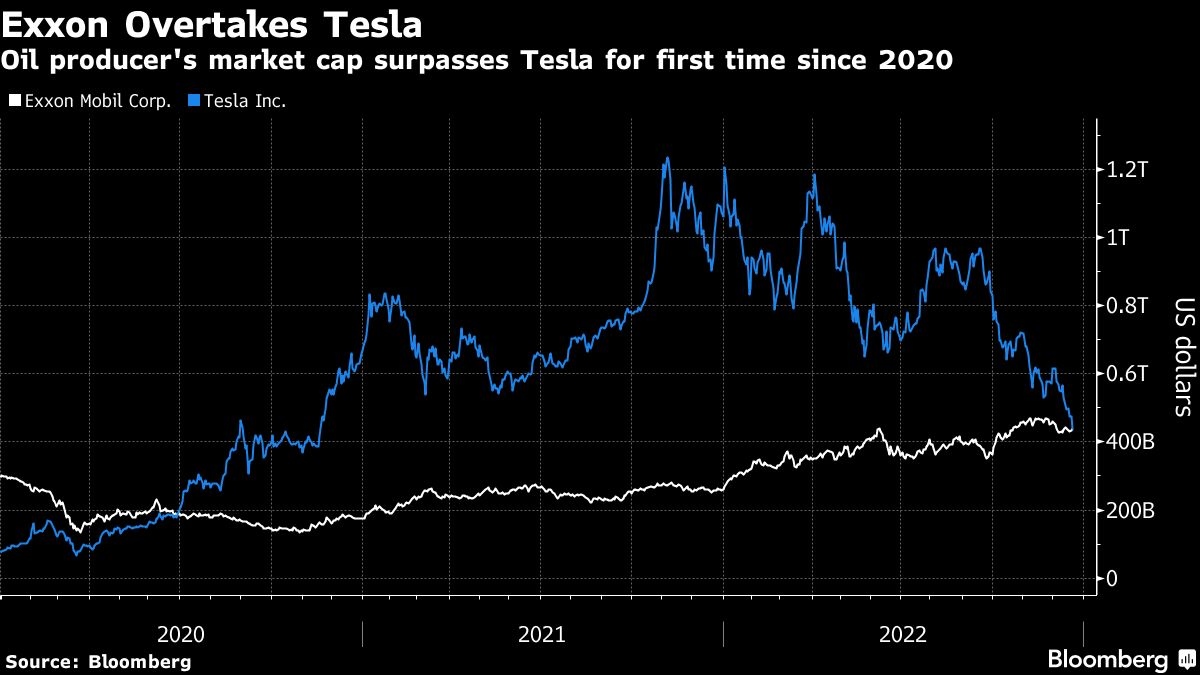

The largest U.S. oil company, Exxon Mobil Corp., has surpassed electric-vehicle giant Tesla Inc. in market value for the first time since 2020 as investors sell high-growth stocks and buy up value stocks in the energy sector.

Exxon shares have soared 75 per cent year-to-date, putting the energy giant on pace for its best ever annual performance, while Tesla’s stock has plummeted roughly 60 per cent over the same period, for its worst annual slump ever.

Broadly, the change in fortunes illustrates how in the face of growing economic and geopolitical uncertainty, investors flocked to businesses with strong cash flow this year, ditching riskier assets whose valuations are pinned to future growth prospects.

Tesla’s own troubles have contributed heavily to the decline as well. Chief Executive Officer Elon Musk’s preoccupation with his acquisition of Twitter and his propensity for controversial Tweets are making investors nervous about his focus and potential damage to the Tesla brand. And the maker of electric cars — which are still relatively more expensive than gas-fueled ones — is expected to see the demand for its vehicles take a hit as consumers postpone or even cancel big-ticket purchases amid a slowing economy, high inflation and rising interest rates.

“In the first part of the year the divergence was caused by a shift away from growth into value,” said Ivana Delevska, chief investment officer at SPEAR Invest. “Now we have a fundamental problem where consumer preference is not shifting to EVs at the rate that was previously expected.”

For its part, Exxon’s equity value has been steadily climbing since hitting a two-decade low in early 2020, when the outset of the Covid-19 pandemic sent crude prices into a tailspin. Since that time, rising crude prices have helped the US oil producer steadily climb back up the ranks of the most valuable companies in the S&P 500, surpassing Facebook parent Meta Platforms Inc. in September and now Tesla. The company’s stock set record highs along the way as it aggressively bought its own shares.

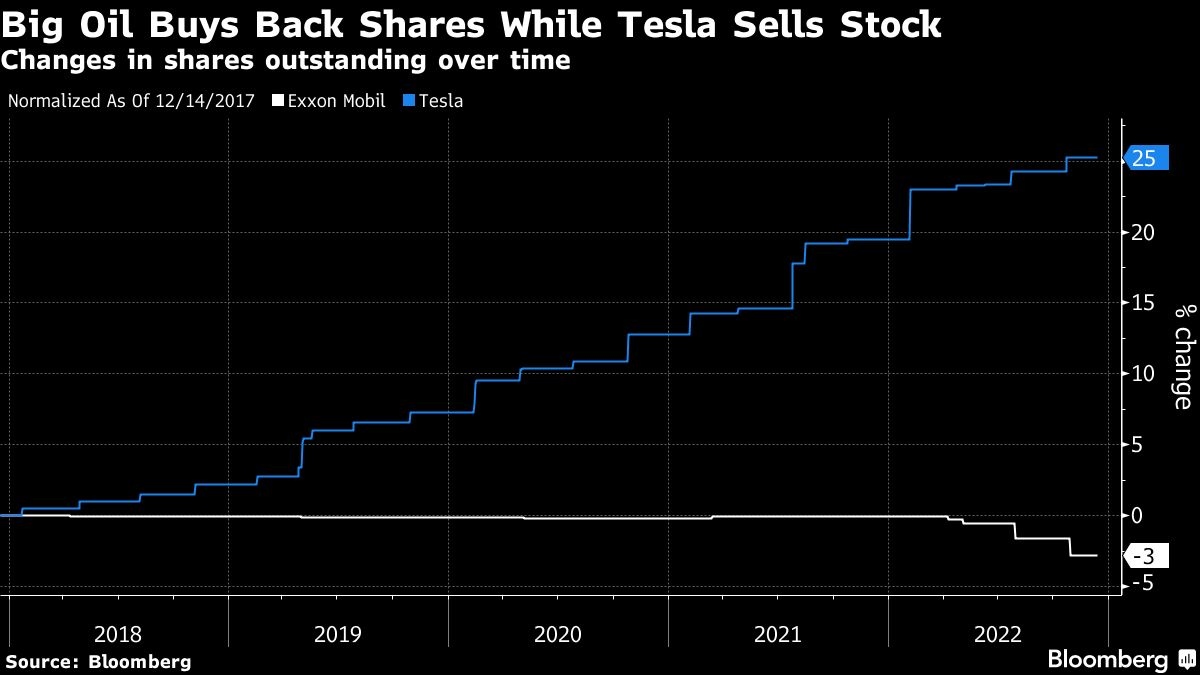

Exxon is reclaiming its title as “the poster child of buybacks” spent US$10.6 billion repurchasing its shares in the 12-months ended Sept. 2022, up from just US$100 million in the preceding year, according to S&P Dow Jones Indices’ Howard Silverblatt. The oil giant plans to spend US$50 billion buying up its own stock through 2024, up from previous plans of US$30 billion.

The share repurchases offer another contrast to Tesla, the growth-oriented stock has issued more of its own shares as it embarked on an ambitious expansion in recent years.

Despite Tesla’s fall, generalist investors remain underweight energy amid concerns about the long-term demand for oil and gas in a world where governments are trying to reduce emissions and encourage electrification.

Exxon and Tesla also traded places on the S&P 500 ESG Index in May, an event that Navellier & Associates chief investment officer Louis Navellier said caused some index-tracking investors to buy up shares in the oil firm and sell stock of the electric car giant. “You are now in an energy renaissance where the world has rediscovered the importance of fossil fuels as the G7 strives to break away from Russian energy,” he wrote in a Dec. 19 note.