Dec 3, 2021

Megacap tech knocked down amid wild stock swings

, Bloomberg News

Stay away from defensive stocks and stick to value: Global strategist

In a week marked by vertiginous swings in financial markets, a sharp selloff in huge technology companies dragged down stocks on Friday.

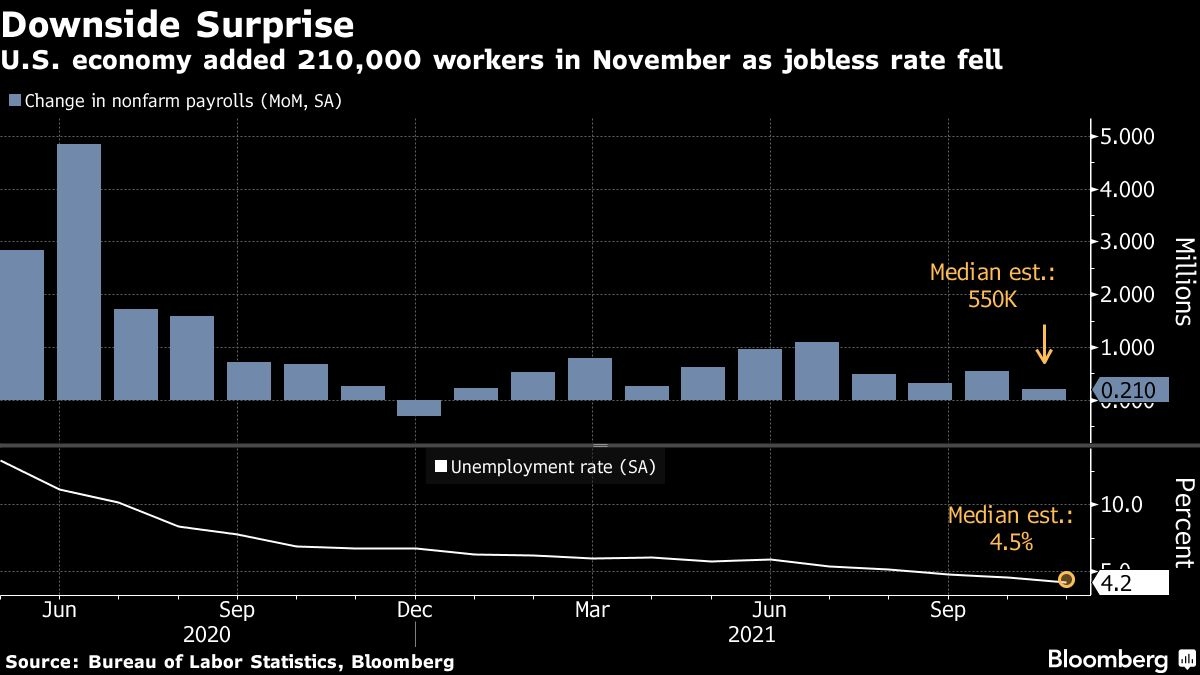

Traders just had a lot to digest over the past few days, from Federal Reserve Chair Jerome Powell’s hawkish tilt to uncertainty about how the omicron coronavirus outbreak could affect the global reopening. A mixed U.S. jobs report did nothing to prevent another bout of intense volatility. The reason is: there’s a perception that the data wouldn’t be a game changer, with policy makers likely to follow through with faster tapering of asset purchases amid elevated inflation.

Stocks extended their weekly slide. Electric-vehicle maker Tesla Inc. sank about 6.5 per cent and Facebook parent Meta Platforms Inc. approached a bear market after a 19.7 per cent plunge from a recent peak. Apple Inc. slipped after news reports that phones of a number of U.S. State Department employees were hacked. China’s companies listed in the U.S. slid amid ride-hailing giant Didi Global Inc.’s preparations to leave American exchanges and regulators’ plans to force foreign firms to open their books or risk delisting.

Haven assets like Treasuries, the Japanese yen, the Swiss franc and gold climbed.

Comments:

- “Today’s non-farm payroll report looks ‘messy’ to me. Best to wait for the revisions next month before sounding the stagflation alarm too loudly. And, if you think this report will push back the accelerated taper mentioned by Fed Chairman Jerome Powell this week, you would be mistaken,” said Jamie Cox, managing partner for Harris Financial Group.

- “The economy is strong, but the labor market is reaching its full potential, and inflationary forces are already elevated, which is why the Fed is feeling more urgency to complete their tapering early,” said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

- “This is a reminder of the uncertainty on the pace of the jobs recovery. It will give the Federal Reserve pause as it considers accelerating its monetary policy tightening. A slower pace would be welcomed by markets,” said Ben Laidler, global markets strategist at multi-asset investment platform eToro.

The Fed’s march toward higher rates presents greater risk for stock investors, and the likelihood of a correction in the S&P 500 next year is “elevated,” according to Bank of America’s Savita Subramanian.

“We are in an environment where the dividend yield on the S&P 500 is below where cash yields are likely to be in a year or two,” the strategist told Bloomberg TV.

The U.S. Treasury again stopped short of labeling any foreign economies as manipulators of their exchange rates, while continuing to say that Taiwan and Vietnam met all three criteria for the designation. Switzerland dropped off the list, last published in April, of countries exceeding the three thresholds, with officials saying it violated two of the criteria while narrowly missing a third.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.8 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 1.7 per cent

- The Dow Jones Industrial Average fell 0.2 per cent

- The MSCI World index fell 0.8 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at US$1.1307

- The British pound fell 0.5 per cent to US$1.3236

- The Japanese yen rose 0.3 per cent to 112.77 per dollar

Bonds

- The yield on 10-year Treasuries declined nine basis points to 1.36 per cent

- Germany’s 10-year yield declined two basis points to -0.39 per cent

- Britain’s 10-year yield declined six basis points to 0.75 per cent

Commodities

- West Texas Intermediate crude was little changed

- Gold futures rose 1.2 per cent to US$1,783.80 an ounce