Apr 21, 2023

Biggest Bitcoin Trading Pair Uses Relatively Obscure Stablecoin TrueUSD

, Bloomberg News

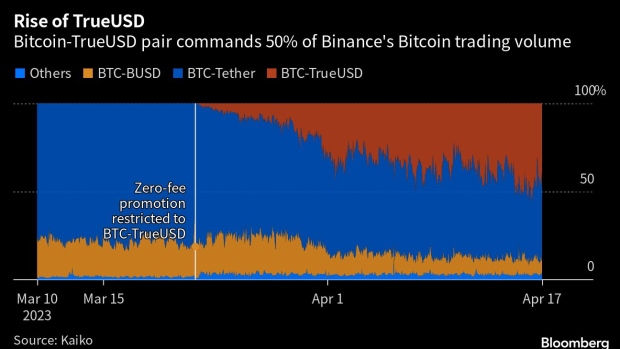

(Bloomberg) -- The TrueUSD stablecoin, a token that was little known until this year, now makes up the largest Bitcoin trading pair in a major shift spurred by the Binance crypto exchange, according to data provider Kaiko.

Binance, the dominant digital-asset platform, scrapped zero-fee Bitcoin trading promotions on March 22 except for Bitcoin-TrueUSD. That stoked demand for the pair, lifting its share of Bitcoin trading volumes on Binance to 50% from negligible levels before the fee decision, Kaiko wrote in a note on Thursday.

The stablecoin “is the benefactor of increased volumes now, even if the reasons why Binance granted TUSD this gift are unclear,” wrote Conor Ryder, a research analyst at Kaiko, using an acronym for TrueUSD.

Stablecoins are key parts of the crypto sector where investors often park funds to use in trading. They are meant to hold a steady value, typically $1, and are often backed by reserves like cash and bonds. Regulators have stepped up scrutiny of stablecoins over concerns about the risks they can pose.

Last year, the wipeout of the TerraUSD algorithmic variant contributed to a $1.5 trillion crypto rout and the collapse of companies like FTX. Second-ranked USD Coin temporarily depegged in the US banking crisis and top stablecoin Tether has faced scrutiny over the transparency of its reserves.

TrueUSD’s circulation surged after New York regulators in February ordered the issuer of a Binance-branded stablecoin, BUSD, to cease minting new tokens. That move shook up the $132 billion stablecoin sector. Whether TrueUSD’s popularity would weather any future removal of the zero-fee promotion on Binance is an open question.

TrueUSD is the fifth-largest stablecoin with a market value of $2 billion, up from about $755 million at the start of 2023, according to CoinGecko data. Top-ranked Tether, or USDT, has a market capitalization of more than $81 billion.

‘Market Depth’

“Market depth data on Binance shows us that BTC-USDT is still king from a liquidity standpoint, with market makers evidently more comfortable with exposure to Tether over TUSD,” Ryder wrote.

Kaiko also pointed out that Tether pairs account for 80% of total trading volumes across centralized crypto exchanges. TrueUSD is on 9% and poised to take second spot in coming months, it added.

TrueUSD on its website says the stablecoin is fully backed by US dollars. The careers part of the website lists San Francisco as its global headquarters.

TrueUSD’s ultimate parent firm is Techteryx Ltd., which bought the intellectual property rights to the asset from Archblock in late 2020. A reserve balance report for TrueUSD dated April 21 indicates Techteryx Ltd. has a base in Singapore. Archblock continues to operate and manage TrueUSD on Techteryx’s behalf via its wholly-owned subsidiary TrueCoin LLC.

©2023 Bloomberg L.P.