Mar 9, 2020

Biggest drop since '87 crash: US$218B lost in Canada stocks

Oil price collapse in 1-minute

Canadian markets were battered on all fronts as the collapse in oil sent shockwaves through a country with one of the biggest exposures to the commodity among the Group of Seven.

The S&P/TSX Composite Index plunged 10.3 per cent, wiping out US$218 billion in market value in the biggest one-day drop since 1987. The loonie also slumped and government bond yields plunged to fresh record lows as investor pessimism deepened for an economy that barely eked out any growth in the fourth quarter and is already grappling with the coronavirus.

Oil and gas stocks plummeted with Meg Energy Corp. tumbling 56 per cent, Cenovus Energy Inc. dropping 52 per cent and Crescent Point Energy Corp. slipping 43 per cent. Only one stock was in the green -- Dollarama Inc., which gained 1.7 per cent.

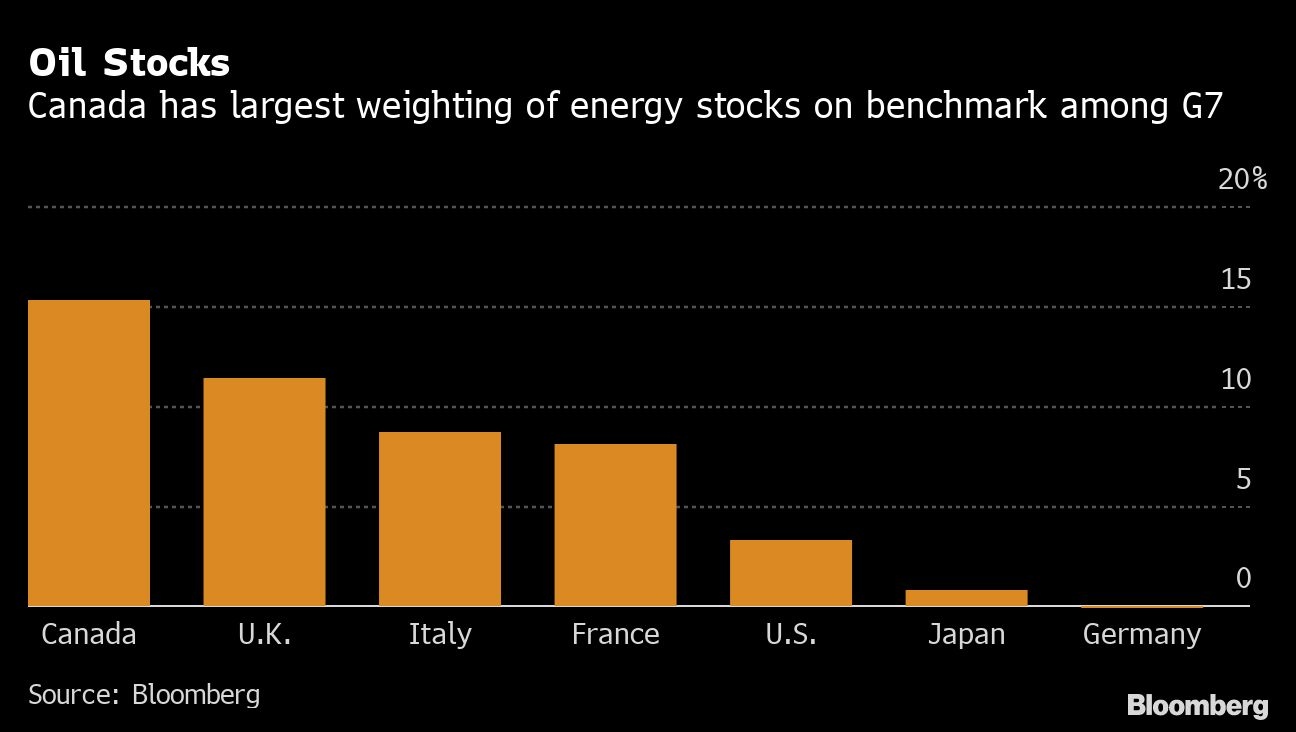

The slump in oil will exact another heavy toll on the natural resource-dependent country, which generates about 9 per cent of its gross domestic product from energy and has the biggest exposure to the sector on its stock market at 15 per cent.

“The oil price crash will do irreparable damage to the Canadian economy and stock market,” said Ed Moya, a senior market analyst at Oanda Corp. in New York. “Canadians will have to brace for lower prices for the foreseeable future and the oil sector will have to consolidate. Even when virus fears ease, the oil-dependent Canadian economy snapback rally will lag their peers,” he said.

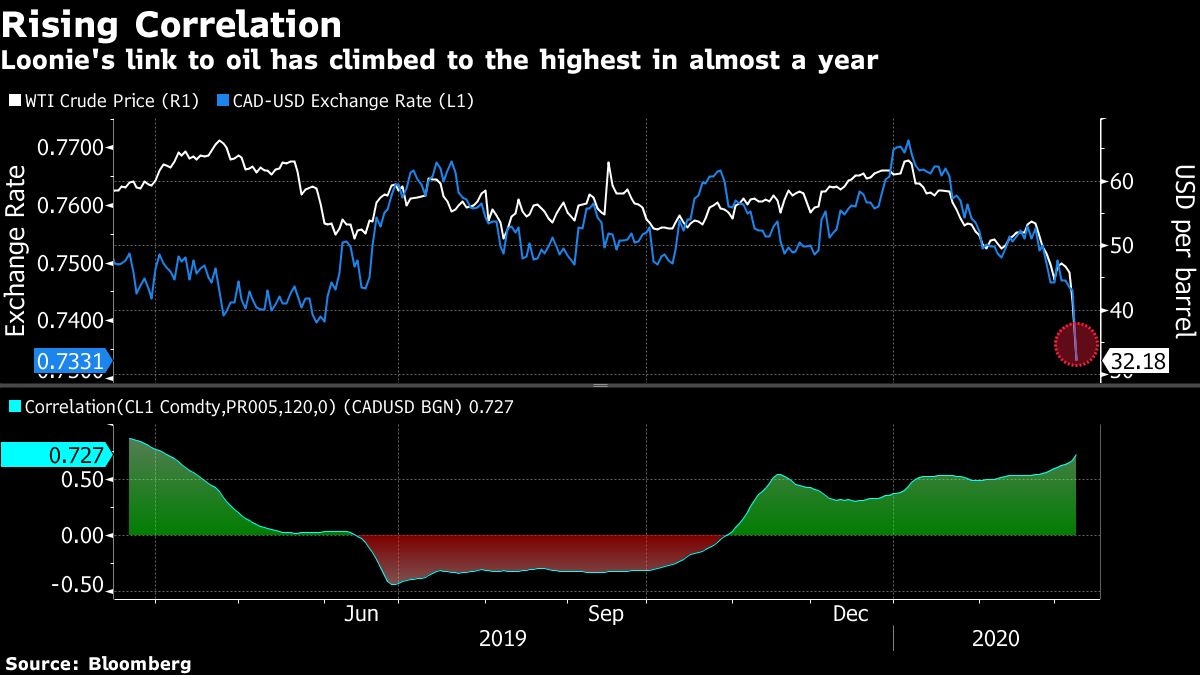

The loonie weakened by about 1.9 per cent against the greenback as of 4:14 p.m., the most since June 2016. West Texas Intermediate, the North American benchmark, was down 25 per cent, the biggest descent since 1991, after tumbling as much as 34 per cent.

“The Canadian dollar is embattled with risks to already weak economic growth coming from all angles,” Simon Harvey a London-based market analyst at Monex Europe Ltd. and Monex Canada Inc., said by email. “Markets are coming to the realization that rate cuts by the Bank of Canada will soon lose their effectiveness on supporting the economy, especially with the latest risk of a lower oil price for longer.”

Further Falls

Harvey sees the loonie falling further away from the CUS$1.30 area if the oil-price rout is sustained while Bipan Rai, North American head of FX strategy at Canadian Imperial Bank of Commerce expects the CUS$1.40 to breached in the the next two quarters.

The loonie “needs to weaken further given the high degree of oil exports as a percentage of Canada’s goods exports,” Rai said. U.S. dollar “bulls may require some patience as price action is overbought, but ‘buy the dip’ is still the right strategy for” the dollar-loonie currency pair.

With the Canadian dollar’s correlation to oil prices, it’s bound to keep weakening.

“The currencies of any country for which the oil sector is a significant growth generator are having an awful day and won’t stabilize until oil finds a bottom,” said Kit Juckes, a strategist at Societe Generale SA, said in an email Monday.

The loonie “is likely to underperform the Australia and New Zealand dollars for example, as long as oil prices are falling.”

The yield on Canada’s 10-year benchmark fell to as low as 0.225 per cent on Monday and the five-year note hit 0.276 per cent, according to Bloomberg data. Traders are now betting on the Bank of Canada, which last week lowered its policy rate to 1.25 per cent, to cut another 50 basis points by its next scheduled meeting in April and another 25 basis points by July.