May 27, 2020

Bill Ackman Gives Up on Warren Buffett

, Bloomberg News

(Bloomberg Opinion) -- What’s Berkshire Hathaway Inc. without its deals? Perhaps not worth owning. That’s the calculation Bill Ackman seems to have made in choosing to exit his stake in Warren Buffett’s company, and who can blame him?

Ackman, the widely followed hedge fund manager, disclosed Wednesday that his firm, Pershing Square Capital Management, sold a short-lived stake in Buffett’s Berkshire Hathaway, an investment that was valued at nearly $1 billion. It’s a telling move from a shareholder who seemed to be all in on Berkshire just weeks ago — perhaps until a normally sanguine Buffett signaled that he was feeling far less certain about how the U.S. recovers from this crisis relative to the many others he’s witnessed in the past.

When Ackman first bought Berkshire shares last summer, he said he was expecting Buffett to spend some of the company’s $100 billion of “excess cash” on large acquisitions and stock repurchases. (Weren’t we all.) That hasn’t happened, even before Covid-19 struck. Still, on March 23 as the virus took hold, Ackman told Bloomberg TV that he added to his Berkshire stake as part of a “recovery bet” on the U.S. economy that involved exiting short positions and using the proceeds to increase certain equity holdings. “We are all long,” Ackman said on air. “No shorts, you know, betting on the country.” Yes, betting on the country the way Buffett was expected to.

What’s changed since then is Buffett’s outlook. Even as Berkshire sits on $137 billion of cash, and as the pandemic would seem to have created cheap buying opportunities, Buffett is selling stocks and avoiding acquisitions. “The cash position isn’t that huge when I look at the worst-case possibilities,” he said during Berkshire’s virtual shareholder meeting earlier this month, leaving his listeners’ mouths agape — maybe Ackman included.

If Buffett isn’t spending, Ackman will. Pershing Square’s managers suggested during a conference call with their own investors Wednesday that they can put money to work faster than Buffett at this stage, which is why it doesn’t make sense to have funds tied up in the stock even though they still see Berkshire as a strong company. It’s hard to argue against that thinking. Buffett’s ability to continuously convert the company’s insurance float and cash into high-return deals and fruitful stock picks has long underpinned Berkshire as an investment. Otherwise, it’s just a collection of sturdy but slow-growing businesses that represent a cross-section of the U.S. economy at a time when the economy isn’t looking so good, as Buffett himself says.

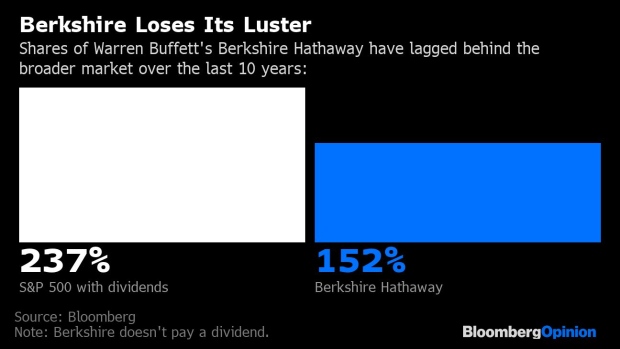

Shares of Berkshire are down 18% this year, compared with a 7% loss for the S&P 500 Index. That under-performance also isn’t new: The stock has trailed behind the benchmark index for the last decade, as the market recovered vigorously from one crisis, then recently plunged back into another. While Buffett says that he still thinks “nothing can stop America,” his actions are making it harder to believe him. And at almost 90 years old, he’s coming dangerously close to leaving his successor stuck with so much cash that it’s less a blessing than a curse.

Berkshire still has a very devoted shareholder base. But it’s a group that looks a lot like Buffett himself: graying, male, not long from retirement. At last year’s shareholder meeting — the real-life one in Omaha — what was evident from looking out at the some 40,000 enthusiastic attendees was that Berkshire needs to work on courting younger investors. Given his deal-making hiatus and Berkshire’s under-performance, they may not have the same fascination with Buffett and his company as his loyal followers do. If even Ackman is saying, in so many words, “With respect, Mr. Buffett, we can do better,” certainly others are starting to feel that way, too.

Then again, it would take just one big, splashy purchase for people to say that Buffett’s got his groove back. That’s probably how he’d prefer to hand off the company, too.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tara Lachapelle is a Bloomberg Opinion columnist covering the business of entertainment and telecommunications, as well as broader deals. She previously wrote an M&A column for Bloomberg News.

©2020 Bloomberg L.P.