Aug 1, 2020

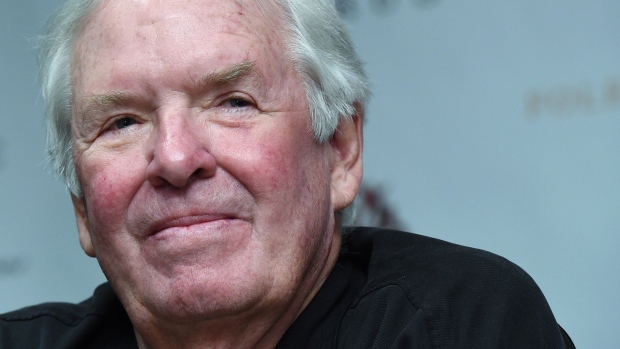

Bill Foley Said to Seek $1.2 Billion in New Blank-Check Deal

, Bloomberg News

(Bloomberg) -- Veteran investor Bill Foley is seeking $1.2 billion through an initial public offering of a blank-check company, less than three months after his other special purpose acquisition company raised $1 billion, according to people with knowledge of the matter.

Foley’s new vehicle will target software and fintech businesses, similar to the one he raised in May, the people said, asking not to be identified because the information is private. Credit Suisse Group AG and Bank of America Corp. are advising the offering, the people said. The size of the deal could change depending the response from investors, they added.

The SPAC market has attracted repeated issuers and some, including Foley, have more than one deal outstanding at a time. Former Citigroup Inc. dealmaker Michael Klein has filed to raise a fourth SPAC while its second vehicle has yet to announce a merger. Venture capitalist Chamath Palihapitiya is searching for targets with his two blank-check firms -- typically set up to merge or buy other companies -- that have raised $1.2 billion combined.

A representative for Foley couldn’t be reached for a comment, while spokespeople at Credit Suisse and Bank of America declined to comment.

Foley Trasimene Acquisition Corp. raised $1 billion in early May. Cannae Holdings, also backed by Foley, entered into a forward purchase agreement to invest $150 million in the closing of Foley Trasimene. The blank-check firm has yet to announce a merger.

That is not Foley’s first attempt at SPAC deals. Foley, alongside former Blackstone Group dealmaker Chinh Chu, was part of blank-check firm CF Corp., which took part in acquiring life insurer Fidelity & Guaranty Life in a $1.84 billion deal in 2017.

©2020 Bloomberg L.P.