Feb 4, 2023

Billionaire Drahi Faces an Unfamiliar Test of Empire Building

, Bloomberg News

(Bloomberg) -- Patrick Drahi has found breathing space in constricted debt markets that once so freely supplied the oxygen needed for his decades of empire building.

The billionaire is grappling with steepening financing costs at his telecom flagship Altice Europe NV and listed American business Altice USA Inc., just as valuations fall and competition increases.

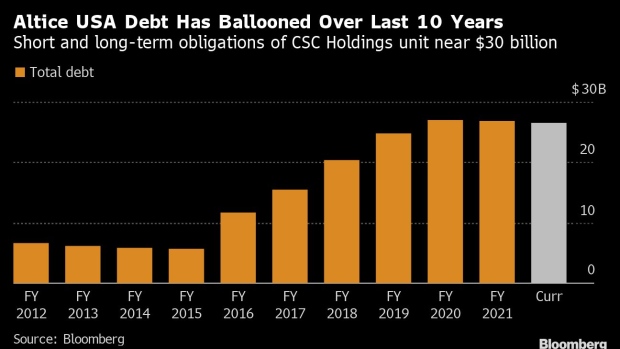

Years of aggressive acquisitions fueled by cheap borrowing have saddled Drahi’s businesses with more than $50 billion of debt and left him having to offer higher interest payments and stronger protections for creditors.

In late January, he managed to extend maturities on about 70% of the equivalent of $8.4 billion in debt held through Altice France SA at an additional annual cost of more than $100 million before tax credits. Selective asset sales are also on the cards at the group and questions remain over Drahi’s prized holdings in storied auction house Sotheby’s, which he could look again at listing this year, and British carrier BT Group Plc, where he’s been increasing his stake.

“He has been experiencing decreasing interest rates for 15 years,” Francois Godard, an analyst at Enders Analysis Ltd., said of Drahi. “He is one of the most in debt, in terms of Ebitda ratios. It’s complex. We’ll see if he was swimming naked.”

Despite having just convinced creditors to push out maturities, there are signs of more obstacles ahead for Drahi as the cost of servicing company debt soars. A substantial portion of Altice’s bonds and loans on both sides of the Atlantic are trading at or near distressed levels and recent efforts to manage borrowings have tested the 59-year-old mogul.

His concessions on the latest amend-and-extend came only months after Altice USA ditched plans to sell cable and internet service provider Suddenlink, which could have raised about $20 billion to help cut debt, after bids came in below expectations, a person familiar with the matter said. A potential disposal of assets in Portugal, meanwhile, came to nothing and despite approaches the company now says it’s not for sale.

Drahi, who was born in Morocco, made his fortune buying up stakes in cable, telecom and internet operators. He is worth some $6 billion today, according to the Bloomberg Billionaires Index—down from $22 billion in June 2015, when he was seeking large takeovers in Europe. Drahi founded Altice in 2002 and, as a prolific dealmaker, grew it through high-profile acquisitions of companies like French carrier SFR Group and Suddenlink and Cablevision in the US.

In the process, he became familiar with the high-wire act of managing heavily indebted companies, in 2018 spinning off his group’s American operation to free it from the highly-levered European parent. About three years later, Drahi completed a take private of the European business following a period of stock volatility linked to its borrowings.

His other big bet has been BT, where he initially took a 12.1% stake in 2021—this rose to 18%. While UK rules temporarily prevented him from launching a takeover offer for the carrier, any such pursuit would almost certainly require extra borrowing to finance. On paper, the investment hasn’t looked great with the company’s shares down about 30% since Drahi bought in.

“We are by far the largest shareholder in BT today, which we feel is a very comfortable situation for now,” Dennis Okhuijsen, a senior adviser with Altice Group, said in an interview. “We think it’s undervalued.”

US Pains

The bigger debt bill comes with the telco already facing increased costs from its strategy to build out fiber networks in America, which Bloomberg Intelligence analyst Geetha Ranganathan said was the right move but an expensive one in the short term. At the same time, its US broadband subscribers—which represent the cable industry’s most prized high-margin business—are declining amid competition from wireless providers.

“They face intense competition in the New York metropolitan area, where they’re heavily concentrated,” Ranganathan said. “We don’t expect any turnaround this year. We suspect they lost as many as 120,000 broadband subscribers in 2022.”

Shares in Altice USA have fallen more than 60% in New York over the last year, giving it a market value of $2.4 billion. Dexter Goei, who runs the US business, has hinted about a take private, telling analysts in November that capital availability is among the advantages of being a privately-held company.

The US arm has hired Lazard Ltd. to advise it on identifying a venture partner to help roll out fiber in new regions, which could help it free up hundreds of millions of dollars, a person with knowledge of the matter said. A representative for Altice USA didn’t immediately respond to requests for comment.

Asset Sales

Altice’s struggles extend to Europe, where its main asset, France’s SFR, has grown less than domestic competitors and failed to boost profitability despite cutting worker numbers by 1,700 since March 2021. Gregory Rabuel left as the French arm’s chief executive officer with immediate effect in August and Drahi and his trusted advisers are now much more involved in its day-to-day running, according to people with knowledge of the matter.

The French telco is comfortable with leverage levels of about 4.5 times earnings because revenue is rising and capital expenditure will reduce after fiber has been built out, according to Okhuijsen. Price increases are also possible, he said.

Drahi is weighing the sale of part or all of a portfolio of French data centers. A deal could value the portfolio at €1 billion or more and potentially help Altice France cut its debt ratio. But workers wonder if additional asset sales may be necessary.

“We have always been told that the debt was not a problem,” workers representative Olivier Lelong said of the French business. “But the rise of the interest rates is worrying to us.”

A representative for Altice Europe declined to comment.

Read more: Billionaire Drahi’s Altice Sees BT Group as ‘Undervalued’

To be sure, Drahi has non-Altice assets to play with should he need more capital. He owns the auctioneer Sotheby’s, as well as digital advertising agency Teads. Initial public offerings of both were being considered before wobbly markets shut the door on new listings in Europe. Drahi had spoken with Abu Dhabi investors about becoming anchor shareholders in a Sotheby’s IPO and may look again at listing the group this year, a person with knowledge of the matter said.

Teads has fallen in value, as has the rest of the market, and is non core, Okhuijsen said. “It makes no sense to look at optimizing the value around it because the market is not really receptive for such transactions today.”

British Bet

BT is one asset Drahi seems keener to hold onto. He’s been an active shareholder in the London-listed carrier, engaging with Chief Executive Officer Philip Jansen about fiber build outs and cost controls. A route to increasing his interest—potentially without sucking up capital—could hinge on fellow BT shareholder Deutsche Telekom AG.

The German telecom giant’s CEO Tim Hoettges has hinted the company is prepared to be a kingmaker in deals involving BT. Analysts have suggested this could involve trading its stake for shares in Altice USA. Drahi’s BT holding would rise to 30% in such a deal though that would trigger a formal takeover offer under UK rules.

For now, BT’s results on Feb. 2 pointed to an alignment with Drahi’s desires. It will cut jobs to help improve profitability, though it has yet to decide on a specific number. It also continues to push its fiber rollout: “We are building like fury and we are connecting like fury,” Jansen told analysts.

Read more: Behind the Debt Binge That Now Threatens Markets

- Sign up for The Brink, our newsletter chronicling corporate bankruptcies, distressed debt, and turnaround stories, delivered Tuesdays and Fridays

--With assistance from Gillian Tan, Scott Moritz, James Crombie and Tara Patel.

©2023 Bloomberg L.P.