May 31, 2023

Billionaire Kretinsky's Plan to Rescue Casino Would Spare $4 Billion of Creditors

, Bloomberg News

(Bloomberg) -- Billionaire Daniel Kretinsky is planning to offer a way out with no losses for Casino Guichard Perrachon SA’s most senior creditors.

The Czech investor, who’s offering to inject fresh capital into the ailing French grocer and take a controlling stake, is working on a proposal that would spare losses for more than €4 billion ($4.3 billion) of secured lenders and noteholders, according to a person familiar with the matter, who asked not to be named because the talks are private.

The proposal includes launching debt buybacks at a deep discount for the company’s €3.6 billion of unsecured and perpetual bonds, but at a higher level than market prices, the person added. Some of these bonds could get converted into equity, eventually leaving the company without unsecured debt, the person said.

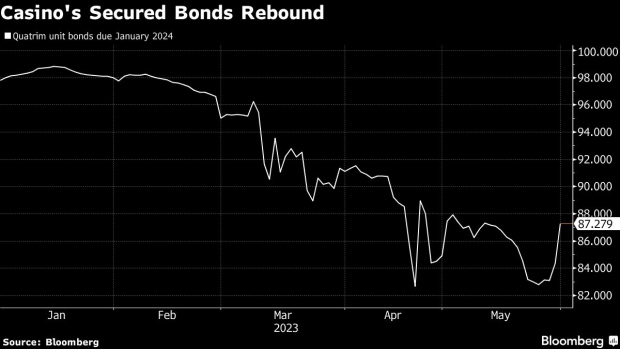

Secured bonds issued under the Quatrim unit due January 2024 gained 2.6 cents on the euro and were indicated at 86.8 cents at 11:50 a.m. Paris time on Wednesday, according to data compiled by Bloomberg. Unsecured notes due March 2024 were 1.5 cents higher at 22.7 cents, the data show.

Spokespeople for Kretinsky and Casino declined to comment.

The offer presented to Casino is indicative and may change depending on findings in the due diligence process and throughout negotiations. As part of the deal, Kretinsky will lead a €1.1 billion capital increase with contributions from minority shareholder Fimalac and also from other existing investors including Chief Executive Officer Jean-Charles Naouri, according to a statement published last month.

The retailer entered a court-supervised debt restructuring process known as conciliation last week after it tried for years to fix its bloated balance sheet with asset sales. Things took a turn for the worse this year as performance deteriorated in its key home market.

Moody’s Investors Service cut Casino’s corporate rating by two levels to nine steps below investment grade on Wednesday because of a “very high probability of a debt restructuring,” according to a statement.

The offer from Kretinsky — who made his fortune investing in coal and gas and is a shareholder of Casino as well as companies including Metro AG, Fnac Darty SA and Royal Mail Group Ltd. — will be discussed in parallel with a plan to merge Casino’s French business with Teract SA, another retailer. Earlier this month, Moez-Alexandre Zouari, Teract’s chief executive officer, said the two offers were not incompatible.

These are the details of Kretinsky’s plan to win over creditors and revamp Casino, according to the person familiar:

(Updates with bond prices in fourth paragraph, rating downgrade in eighth and chart)

©2023 Bloomberg L.P.