Nov 19, 2018

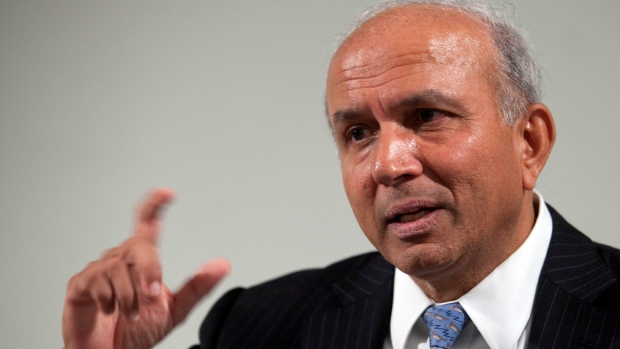

Billionaire Watsa becomes second-biggest shareholder in Stelco

, Bloomberg News

Billionaire Prem Watsa’s investment company, Fairfax Financial Holdings Ltd. (FFH.TO), has taken an almost 14 per cent stake Stelco Holdings Inc.(STLC.TO), even as Canada and the U.S. remain embroiled in a battle over steel and aluminum tariffs.

Fairfax acquired 12.2 million shares in the Hamilton, Ont.-based steel manufacturer representing about 13.7 per cent stake, the company said in a statement Monday. It paid $20.50 per share for a total cost of about $250 million. The shares closed Friday at $19.67 in Toronto

Toronto-based Fairfax has assets around the world, with Watsa particularly enthused by opportunities in India. In April, he said the insurance and investment company was stockpiling cash as it looked for cheap stocks. At the time, he said Canada would have a hard time competing for capital following massive U.S. tax cuts.

Costs associated with steel tariffs between the U.S. and Canada are expected to fall in the fourth quarter, Stelco’s Chief Executive Officer Alan Kestenbaum said during the earnings call last week. The company expects higher shipments, stable pricing and higher earnings in the quarter after reporting third quarter profit that beat analysts’ expectations.

Fairfax purchased the shares from Bedrock Industries, Kestenbaum’s U.S.-based private equity firm. That pushes Bedrock’s stake in Stelco to about 46.4 per cent from 60.1 per cent and makes Fairfax the second-largest shareholder, according to data compiled by Bloomberg.

While Canada and the U.S. reached a deal to replace the North American Free Trade Agreement, the metals tariffs are slated to be dealt with separately and the sides remain at odds.

--With assistance from Kristine Owram