Jul 31, 2022

Billions Pulled From Europe’s Controversial ESG Investing Fund Category

, Bloomberg News

(Bloomberg) -- Asset managers love them, while clients seem increasingly wary of them: Article 8 funds.

It’s a category within Europe’s ESG investing rulebook that saw huge growth last quarter, as the asset-management industry slapped an Article 8 -- also known as “light green” -- tag on well over 600 funds that previously weren’t classified as sustainable, according to data provided by Morningstar Inc. At the same time, clients withdrew more than $30 billion from such products. A stricter environmental, social and governance classification -- Article 9 -- saw $6 billion of inflows.

When an asset manager sells a fund as Article 8, they’re promising clients that their money will go toward “promoting” sustainability. It’s a concept that was enshrined in the EU’s Sustainable Finance Disclosure Regulation, which started being enforced in March 2021 as the world’s boldest anti-greenwash rulebook to date. But 16 months on, there’s hardly any agreement within the fund industry as to what “promoting” sustainability means. What’s more, even regulators in the EU don’t really see eye to eye.

For investment clients trying to decide where to get the most bang for their ESG buck, it’s now “impossible” to do a meaningful comparison across products, according to Morningstar.

Meanwhile, there continue to be questions around the ESG-ness of Article 8. A Morningstar data analysis found that roughly two-thirds of Article 8 funds target between zero and 10% minimum exposure to sustainable investments.

A new regulatory framework is taking effect that will require financial advisers to make sure they’re taking ESG retail clients’ expectations into account, and explaining the characteristics of financial products in a way that doesn’t lead to misunderstandings. It’s an amendment to the revised Markets in Financial Instruments Directive that law firm Simmons & Simmons, which advises asset managers, has already suggested will add a new layer of risk to the asset-management industry.

“Because of patchy data and a lack of direct comparability between products, financial advisers will struggle to fulfill their new obligations,” according to Morningstar.

NEWS ROUNDUP

Social Taxonomy Shelved | The next milestone in Europe’s efforts to create a global benchmark for ESG investing has been shelved indefinitely as officials balk at devoting resources to a process that’s already marred by deep political division.

Meta Reacts to Data Pact | Meta Platforms Inc. reiterated its threat to pull its popular Facebook and Instagram services from the European Union if a new transatlantic data transfer pact doesn’t materialize. Its latest warning comes amid an imminent data flow ban it already faces from Ireland’s data-protection watchdog, which oversees the tech giants based in the country.

Fashion Probe | The UK’s competition watchdog started a probe into potentially misleading environmental claims made by fashion brands Asos Plc, Boohoo Group Plc and George at Asda, over greenwashing concerns.

ISSB Faces Criticism | The organization aiming to set worldwide climate reporting requirements for decades to come is under fire for putting corporate interests ahead of the planet’s.

Pimco Downgrades ESG Funds | Pacific Investment Management Co. and NN Investment Partners have cut the ESG status of a number of their funds after European authorities clarified rules guiding such classifications.

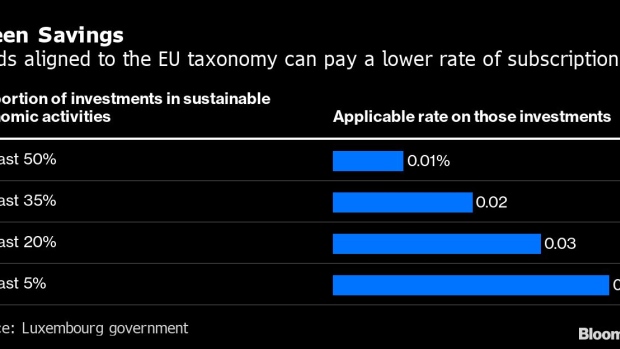

No Tax Break | In Luxembourg, the world’s biggest hub for ESG asset managers, firms have been unable to take advantage of a tax break intended to reward their efforts to do more sustainable investing.

Banks Fall Short | The world’s biggest banks are coming up short in their efforts to rein in global warming, according to an investor group representing more than $50 trillion of assets.

EU Climate Benchmarks | Investment funds tracking EU-regulated climate benchmarks jumped 25% last quarter, as asset managers look for ways to combat greenwashing.

EU Deal to Cut Gas Use | European Union countries reached a political agreement to cut their gas use by 15% through next winter as the prospect of a full cutoff from Russian supplies grows increasingly likely.

Gas and Nuclear | EU lawmakers voted to allow natural gas and nuclear energy to be labeled as green investments, removing the last major barrier to potentially billions of euros of funding from environmental investors.

US Climate Deal | In a breakthrough that surprised much of Washington, Senate Majority Leader Chuck Schumer and Senator Joe Manchin announced that they agreed on a plan that includes a record $370 billion in spending to fight climate change.

US States Target Banks | West Virginia will restrict BlackRock Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley and Wells Fargo & Co. from state banking contracts after the Republican state treasurer found that the companies engage in a so-called boycott of the fossil-fuels industry.

FSB Warns Banks | Financial institutions should brace for greater scrutiny as the world moves toward a low-carbon economy, the Financial Stability Board said in a report.

EU Targets Insurers | The EU’s top insurance regulator wants national authorities to tighten supervision amid evidence companies are using artificial intelligence to drive up prices unrelated to the risk or cost of service.

BLOOMBERG RESEARCH

Guarding Against Greenwashing | As ESG has increasingly affected investment decisions in Europe, the need for transparent and comparable data has become pivotal. Public-company disclosures can differ drastically, as reporting standards are new and often changing. Bloomberg and MSCI were the most frequently named as the No. 1 or No. 2 source of ESG data among European funds that were surveyed.

Most traders named multiple providers, suggesting they value various data inputs, and there’s room for competition. Almost a quarter of traders surveyed believe greenwashing accounts for more than 50% of ESG. Small funds were surprisingly more pessimistic, as they showed more support for ESG throughout the study.

What percentage of ESG is greenwashing?

US Climate Bill’s Impact | Vestas Wind Systems AS, First Solar Inc., SolarEdge Technologies Inc. and other clean-energy equipment suppliers may see elevated US demand for wind and solar energy in 2023-2025 -- with potential upgrades to consensus sales expectations -- if the Inflation Reduction Act becomes law.

Carbon Border Tax | This will be a “make or break” year for launching a carbon tariff on imported goods, according to BloombergNEF. The European Commission has proposed levying a tariff on iron and steel, aluminum, fertilizers and cement. In addition, the European Parliament wants to include organic basic chemicals, plastics and hydrogen. With introduction planned for next year, “consensus on devilish questions around coverage, timeline and exports is lacking,” analyst Antoine Vagneur-Jones wrote in a July 27 report.

OFF THE SHELF

ESG Meets Real World | ESG has become a punching bag for the far right, disgruntled corporate executives and even industry insiders.

Taxonomies | Floods, droughts and food shortages are just some of the effects of climate change, while exploitation and corruption drive social injustice around the world. Governments tackling these issues are realizing that to solve them, they need first to define and measure them. Some are turning to so-called taxonomies that establish which economic practices and products are harmful to the planet and which aren’t. The idea is that the price of goods and services must reflect the human and environmental cost of both production and disposal, which in turn would spur much-needed change. But designing a code is fiendishly difficult.

OTHER ESG-F0CUSED FIXTURES

Run NSUB ESG to subscribe to the ESG newsletters listed below:

- For the ESG Daily newsletter, click here

- For the daily “Green Insight” newsletter, click here

- For the weekly wrap of ESG bond sales, click here

- For the weekly ESG Investing digest, click here

- For the weekly wrap of Equality news, click here

©2022 Bloomberg L.P.