Dec 5, 2022

Binance Sees 30% Surge in Trading Activity on FTX Implosion

, Bloomberg News

(Bloomberg) -- Digital-asset exchange Binance Holdings Ltd. saw a substantial boost in trading activity as Sam Bankman-Fried’s FTX crypto empire collapsed in November.

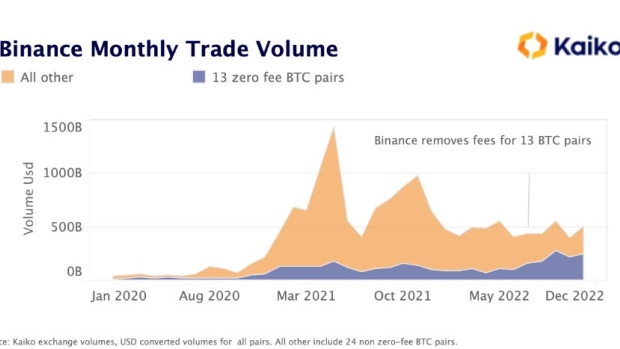

Trading activity on the largest crypto exchange jumped by 30% last month, when FTX had a liquidity crunch that eventually led to its bankruptcy and wrecked havoc on the crypto market. The catalyst for the collapse was Binance Chief Executive Officer Changpeng “CZ” Zhao’s Nov. 6 announcement that the exchange was selling its holdings of FTT because the native token of FTX was too risky. FTX had operated the second-largest spot and derivatives exchanges.

“Monthly trade volume jumped by 23% to $705 billion for the largest exchanges in November, bolstered by FTX-related volatility.” researcher Kaiko noted in a Dec. 5 newsletter. “The increase was mainly driven by Binance.”

The Bloomberg Galaxy Crypto Index tumbled about 18% in November. The index is down about 67% this year.

Users seeking to pull their funds from FTX sparked the contagion spreading across the crypto industry. Genesis Global Trading warned of bankruptcy if it could not raise enough funding. The difficulties at Genesis prompted crypto exchange Gemini to halt redemptions from its Earn product. Binance disclosed its assets and wallet addresses where the exchange stores the customers’ funds in an attempt to improve transparency.

“Binance may benefit, despite not having an official headquarters, because it has projected an image of strength through the crisis with the best liquidity of any centralized exchange,” according to the newsletter.

The fall of FTX can also benefit US-regulated exchanges such as Coinbase and Kraken, which have gone through significant layoffs. Trading volume from the exchanges were on the rise in November as well, while activity on smaller exchanges fell, given the higher volume from users and institutions who have become wary of off-shore exchanges, according to the newsletter.

©2022 Bloomberg L.P.