Mar 22, 2019

Binging on Beer & Whisky: Taking Stock

, Bloomberg News

(Bloomberg) -- In a market driven by trade jitters, politics and monetary policy, investors have found comfort in food and drinks, and apparently more in the latter than the former. While it’s not surprising to see defensive shares thrive in tough times, the Stoxx Europe Food & Beverage (SX3P) gauge keeps reaching new highs.

The SX3P is up 17 percent this year, trading at a record high, and although retail (SXRP) and basic resources (SXPP) have fared slightly better in the period, food & beverage was more resilient in 2018 and is still delivering.

Since the beginning of the year, beer and spirits producers have been the strongest stocks in the sector index. AB Inbev tops the table, recovering after a 38 percent fall in 2018. As for the heavyweights, Nestle’s gains have been impressive, especially as investors have favored risk assets over defensive stocks overall in 2019.

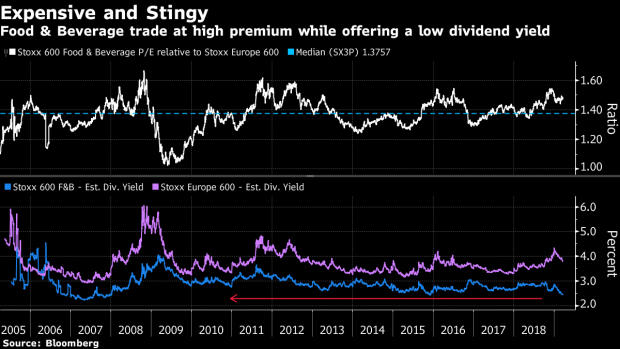

If you’re after value and yield, then you can pass. With a forecast price-to-earnings ratio around 20.5 times, the sector is trading near a 50 percent premium to the Stoxx Europe 600 (trading at 14 times). In term of dividends, these stocks are usually not very generous and carry a low yield. AB InBev even cut its payout significantly last year to focus on deleveraging its balance sheet.

The relative strength of Europe’s food and drink stocks isn’t new. The sector is a long-term outperformer. In addition to their inherent defensive appeal, spirits producers have also been helped by a shift to premium brands, boosted by higher spending across the globe and in emerging markets in particular, according to Chris Beauchamp, chief market analyst at IG Group.

However, the industry’s shares also have regular periods of underperformance, so caution might be necessary. Beauchamp says the sector “has probably got ahead of itself” in the short term. Still, if bond yields continue to retreat, and if flows comes back to European stocks, the picture will get even more attractive, he says. Ahead of the open today, Euro Stoxx 50 futures are trading up 0.1%, while FTSE 100 futures are down 0.4%, after European Union leaders gave Theresa May another two weeks to avoid a no-deal Brexit.

SECTORS IN FOCUS TODAY:

- Watch the pound and U.K. stocks after the EU will give the U.K. a two-week delay to the exit date to allow Theresa May to get the situation sorted out and avoid crashing out of the bloc with no agreement, which would incidentally probably look a little like this.

- Watch Puma and Adidas after U.S. peer Nike’s shares dropped after growth in its North American arm missed expectations, overshadowing an otherwise strong 3Q update. Jefferies analysts say the broker’s data work indicates Nike is continuing to win back market share lost to Adidas in North America through its strong new product line.

COMMENT:

- “Our ‘Don’t Panic’ analysis provided an enhanced buy signal for European equities at the start of this year,” Citi strategist Jonathan Stubbs writes in a note. “Our ‘Don’t Panic’ median pathway suggests there are further gains ahead and support our end-2019 Stoxx target of 400. Investors remain unconvinced, eg record 12m rolling net outflows from European equities. Plausible scenario of modest dividend growth and share prices closing gap to dividends = 30%+ upside to end-2020.”

COMPANY NEWS AND M&A:

- Deutsche Bank Points Out Somewhat Weaker Market Conditions

- Elliott, Vivendi Said to Be Open to Settle Telecom Italia Tussle

- StanChart Faces Investor Criticism Over CEO Pay, FT Reports

- BioArctic, Eisai Continue Preparations for BAN2401 Phase 3

- Novo’s Board Will Review Wages After Criticism, Borsen Says

- Swedbank Board to Conduct Deeper Review After FRA Update on AML

- Credit Suisse CEO Gets a 30% Pay Rise for Completing Turnaround

- BHP Halts Pyrenees Oil Output as Australian Cyclone Nears Coast

- Nokia Has Come Across Compliance Issues With Alcatel Lucent

- Deutsche Bank Merger Could Mean 500 Branch Closures, Bild Says

- Debenhams Is Close to Securing Funding Lifeline: Sky News

- Enel 2018 Adj. Net Slightly Misses Est; 2019 Targets Confirmed

- Nasdaq Confident of More Acceptances in Oslo Bors Offer, FA Says

TECHNICAL OUTLOOK for Stoxx 600 index:

- Resistance at 392.7 (July high); 397.9 (May high)

- Support at 379.9 (23.6% Fibo); 369.2 (200-DMA)

- RSI: 65.4

TECHNICAL OUTLOOK for Euro Stoxx 50 index:

- Resistance at 3,466 (23.6% Fibo); 3,596 (May high)

- Support at 3,349 (August low); 3,315 (38.2% Fibo)

- RSI: 64.8

MAIN RESEARCH AND RATING CHANGES:UPGRADES:

- Aggreko upgraded to buy at Stifel; PT 8.80 Pounds

- Alstria Office upgraded to neutral at JPMorgan; PT 16 Euros

- EDP upgraded to buy at Goldman; PT 3.80 Euros

- Pearson upgraded to overweight at JPMorgan; PT 10.50 Pounds

- TLG Immobilien upgraded to overweight at JPMorgan; PT 31 Euros

DOWNGRADES:

- ADO Properties downgraded to hold at ING; Price Target 56 Euros

- Lagardere cut to equal-weight at Morgan Stanley; PT 28 Euros

- MTG downgraded to hold at Kepler Cheuvreux; PT 350 Kronor

- Ophir Energy downgraded to hold at Jefferies; PT 60 Pence

- Saipem downgraded to hold at HSBC; PT 5 Euros

- Vestas downgraded to underweight at JPMorgan; PT 485 Kroner

- Wacker Chemie downgraded to hold at LBBW; PT 90 Euros

INITIATIONS:

- Centamin Rated New Hold at Peel Hunt; PT 95 Pence

- Learning Tech rated new buy at Goldman; PT 1.13 Pounds

- Scandic rated new sell at Berenberg; PT 76 Kronor

MARKETS:

- MSCI Asia Pacific up 0.1%, Nikkei 225 up 0.1%

- S&P 500 up 1.1%, Dow up 0.8%, Nasdaq up 1.4%

- Euro up 0.05% at $1.138

- Dollar Index down 0.21% at 96.29

- Yen up 0.02% at 110.8

- Brent up 0.1% at $67.9/bbl, WTI little changed at $60/bbl

- LME 3m Copper up 0.2% at $6435.5/MT

- Gold spot up 0.1% at $1311.1/oz

- US 10Yr yield down 1bps at 2.53%

MAIN MACRO DATA (all times CET):

- 8:45am: (FR) 4Q F Wages QoQ, est. 0.3%, prior 0.2%

- 9:15am: (FR) March Markit France Services PMI, est. 50.6, prior 50.2

- 9:15am: (FR) March Markit France Composite PMI, est. 50.7, prior 50.4

- 9:15am: (FR) March Markit France Manufacturing PMI, est. 51.4, prior 51.5

- 9:30am: (GE) March Markit/BME Germany Manufacturing PMI, est. 48, prior 47.6

- 9:30am: (GE) March Markit Germany Services PMI, est. 54.8, prior 55.3

- 9:30am: (GE) March Markit/BME Germany Composite PMI, est. 52.8, prior 52.8

- 10am: (EC) Jan. ECB Current Account SA, prior 16.2b

- 10am: (EC) March Markit Eurozone Manufacturing PMI, est. 49.5, prior 49.3

- 10am: (EC) March Markit Eurozone Services PMI, est. 52.7, prior 52.8

- 10am: (EC) March Markit Eurozone Composite PMI, est. 52, prior 51.9

- 10am: (IT) Jan. Current Account Balance, prior 4.21b

--With assistance from Joe Easton.

To contact the reporters on this story: Michael Msika in London at mmsika4@bloomberg.net;Lisa Pham in London at lpham14@bloomberg.net

To contact the editors responsible for this story: Blaise Robinson at brobinson58@bloomberg.net, Jon Menon

©2019 Bloomberg L.P.