Oct 22, 2019

Biogen Alzheimer’s Drug Is Far From Done Deal, Wall Street Says

, Bloomberg News

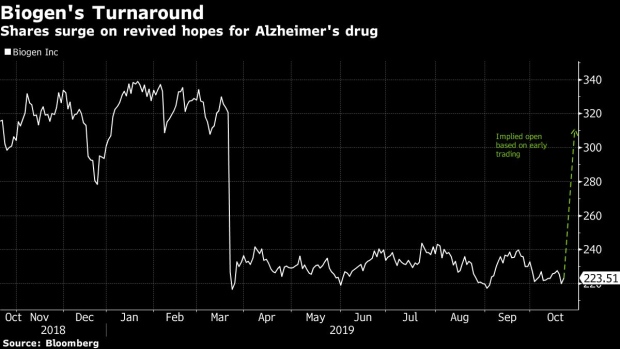

(Bloomberg) -- Nobody saw it coming. Biogen Inc. stunned investors with its surprise Alzheimer’s drug submission on Tuesday, reviving hopes for an experimental medicine that investors had mostly left for dead. Shares surged as much as 40% in early trading, and may have room to rise even more, according to SVB Leerink.

Wall Street analysts have expressed some newfound optimism that the drug may now have a path forward. But the majority view is still that FDA approval is far from a done deal. Here’s what they’re saying:

RBC, Brian Abrahams

“Somewhat incredibly,” Biogen reported clinical activity from its Phase 3 Alzheimer’s drug, aducanumab, which had been halted back in March. It’s still unclear whether the data would meet the bar for FDA approval or broader commercial adoption, Abrahams said.

New data in Biogen’s earnings slides indicate a “shakier ground” for aducanumab’s prospects, the analyst wrote. The data from the “Engage” study, which did not reach its primary goal but which Biogen had indicated as supportive for the filing, show that at the high dose, the medicine did not show any benefit and even worsened symptoms for some patients.

“Though FDA apparently provided some endorsement for the idea of filing, which could maintain some probability of approvability, we believe the new details suggest the data may be more mixed than initially perceived,” he wrote.

Sector perform, PT $236

Cowen, Phil Nadeau

Biogen’s “rationale makes sense, but it’s unclear to us if the totality of the data support FDA approval,” the analyst said. “Nonetheless, as people had thought BIIB’s Alzheimer’s program was not viable today’s news suggests that there may still be a path to market.”

Outperform, PT $275

SVB Leerink, Geoffrey Porges

“At first pass the results still appear to be marginal, with inconsistent treatment effects between the two studies and for different endpoints, but the critical question will be what reassurance the company has received from the FDA,” the analyst wrote. “This could range from ’the agency has reviewed all the data with us and has guaranteed approval’ to ’you can file whatever you want and we’ll review it’.”

Biogen’s filing will now come down to a “torturous discussion” of data, statistics, treatment effects and safety liabilities and will likely not include the societal and economic costs of further studying the devastating disease.

Shares could trade in the $400 range as investors give “partial” credit for aducanumab, Porges estimates. Full value for the drug could price the stock as high as $485-$525, he wrote.

Market perform, PT $256

Jefferies, Michael Yee

Investors and analysts will continue to debate the potential approval but its drug submission makes it another binary outcome for shares next year. The stock is now pricing in around a 35%-50% chance as it is back to $300 and where it was around the time before the drug failed, the analyst said.

Yee also agrees it makes sense for Biogen to file and try to get the drug approved since it has done the work and spent money on studies. “There is some argument FDA might accept all of this data given the significant unmet need, but our questions would be mostly on how convincing is the data for FDA,” he wrote.

Hold, PT $255

To contact the reporter on this story: Tatiana Darie in New York at tdarie1@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Scott Schnipper

©2019 Bloomberg L.P.