Jun 22, 2018

Bitcoin approaches year low as Japan cracks down on venues

, Bloomberg News

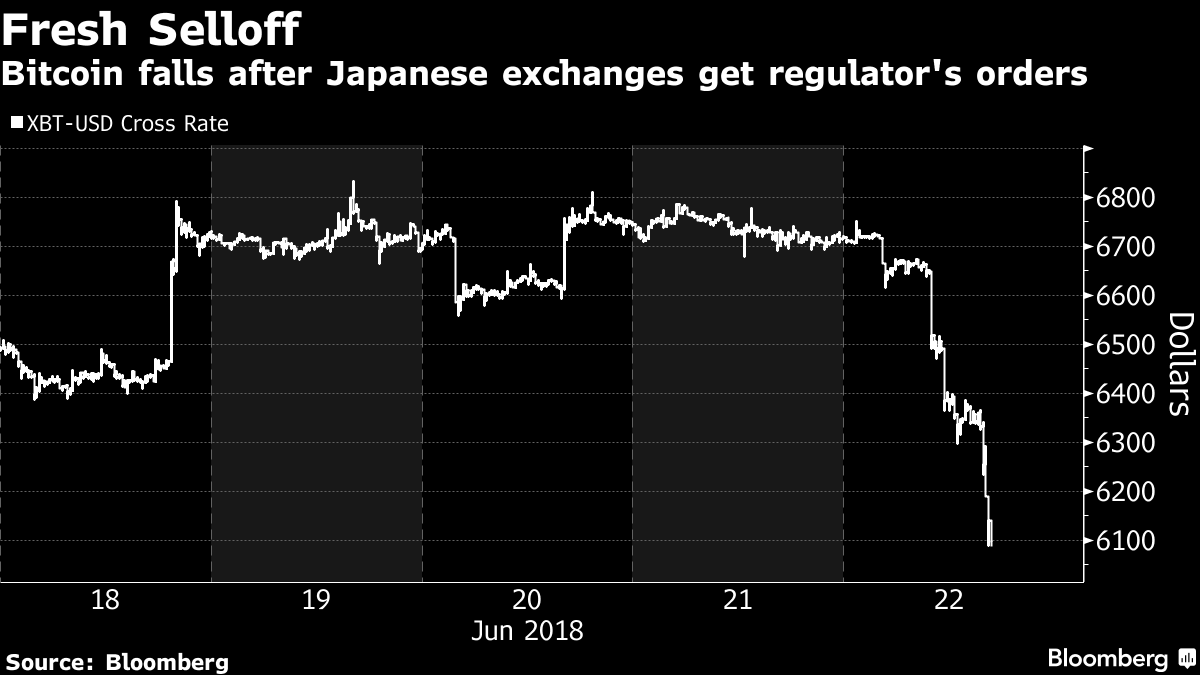

Bitcoin approached its lowest price for the year after Japanese regulators hit six of the country’s biggest cryptocurrency trading venues with business-improvement orders.

The crackdown surprised investors, ending what was about to be the first winning week since early June for the largest digital coin and for the 10 most-liquid tokens. The MVIS CryptoCompare Digital Assets 10 Index tumbled as much as 11 per cent on Friday. The gauge already fell in five of the past six weeks.

Some of the targets of Japan’s regulator were quick to react. Bitflyer Inc. said it would stop accepting new customers and also review identity verification for some existing users after it received an order from Japan’s Financial Services Agency. The FSA called for improved measures at all the exchanges against money laundering. The companies must submit their plans by July 23.

Peer-to-peer money has come under fresh pressure in recent weeks after two South Korean exchanges said they were hacked. That raised fresh concerns about the security of investor holdings. New pressure in Japan, one of the most crypto-friendly jurisdictions, demonstrated the market’s fragility to regulatory moves in the absence of much positive news.

“The market is still trading on low volumes and has yet to break out of its current downtrend, leaving itself susceptible to sell-offs,” said Ryan Rabaglia, head trader with cryptocurrency dealing firm Octagon Strategy Ltd. in Hong Kong, in an email. “Although the market reacted negatively, I view this as a positive for the industry as a whole.”

Bitcoin, the largest cryptocurrency, sank as much as 9.6 per cent and was trading at US$6,154 as of 10:10 a.m. in New York, according to consolidated Bloomberg pricing. That brought its year-to-date loss to 57 per cent. The low for the year of US$5,922 was set on Feb. 6. Ethereum and Litecoin both retreated by more than 11 per cent.

Targets Named

QUOINE, Bitbank, BTCBOX, BITPoint Japan and Tech Bureau were the other exchanges penalized by the FSA. While Japan created a regulatory framework for exchanges last year that proved a lure for bourses, the US$500 million heist in January at Coincheck Inc. prompted the country’s regulators to increase scrutiny of the industry.

In April, bitFlyer tightened its anti-money laundering rules after the Nikkei newspaper reported that users could perform some limited functions without fully completing customer verification.

Yuzo Kano, bitFlyer’s chief executive officer, apologized on Friday for the FSA sanctions. “We deeply apologize for causing concerns and inconvenience,” he said in a tweet. “We take this order seriously and will make all efforts to improve our operations.”

Transactions on bitFlyer averaged about US$2 billion a day during late April and early May, thanks in large part to Bitcoin margin contracts popular with Japanese day-traders. The venue had 2 million users, Bloomberg reported last month.

“The market is quite soft, with liquidity lower across the board, especially compared to recent quarters,” said Tiantian Zhang Kullander, a partner of Amber AI Group, a crypto hedge fund. “The FSA punishing operators, the BIS report and the Bithumb hack are all affecting sentiment.”