Sep 1, 2022

Bitcoin dips below US$20,000 for a sixth session as 'fear' sets in

, Bloomberg News

Mike Philbrick discusses The Bitcoin Fund

Bitcoin fell below US$20,000 for a sixth consecutive trading session, the longest stretch of days that it has dipped under that closely-watch level since the crypto market was rocked by turmoil in July.

The largest cryptocurrency by market value declined as much as 3.1 per cent to US$19,577 on Thursday. Most other digital tokens were also lower, with Ether dropping 1 per cent, Avalanche off 3.9 per cent and Solana down 4.3 per cent as of 1:58 p.m. in New York.

“If you look at the charts, Bitcoin does look weak,” said Garry Krugljakow, founder of GOGO Protocol, an open-source DeFi protocol for asset management and savings. “The sentiment indicators are pointing to maximum fear.”

The crypto sector has contracted to less than US$1 trillion, or about a third of its all-time market value reached in November. After coming of the highs amid a general increase in risk aversion, coin prices were rocked midyear by the collapse of the Terra ecosystem, the demise of the Three Arrows Capital and the bankruptcy of broker Voyager and lender Celsius.

“There is a lot of fear that if we make new lows on BTC (as a proxy for the market), there will be another wave of crypto company defaults,” said Stephane Ouellette, chief executive of FRNT Financial Inc.

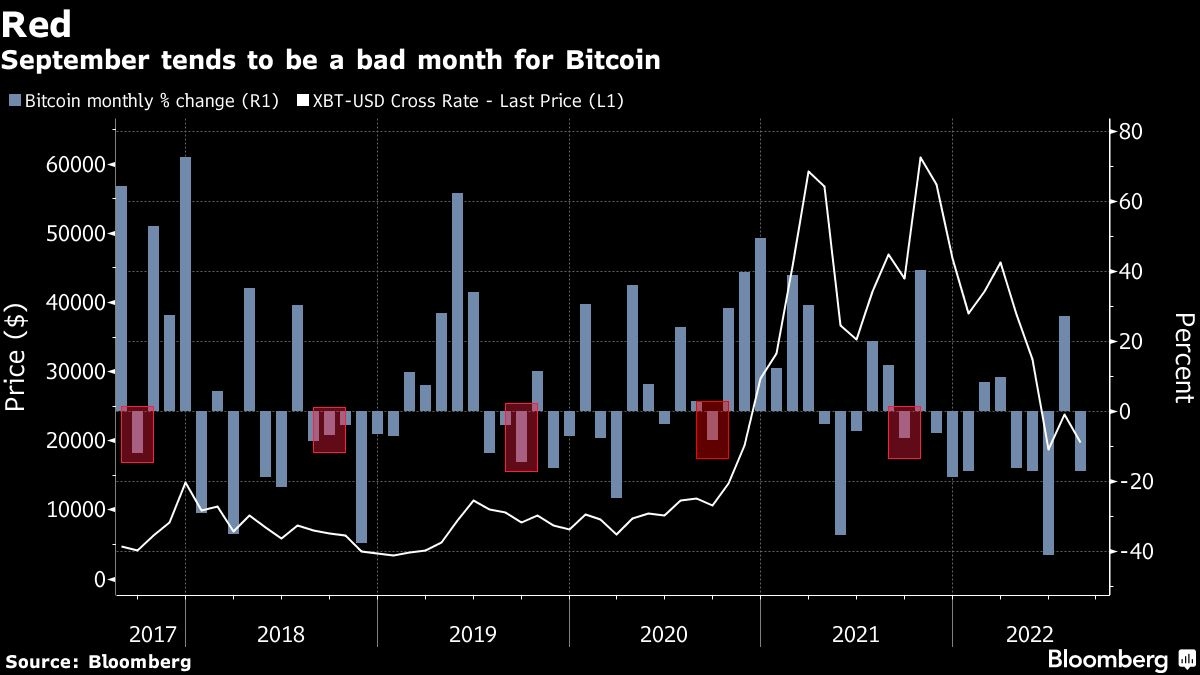

The decline on the first day of September doesn’t bode well for the bellwether coin. The ninth month of the year has historically been one of the worst for Bitcoin, which has fallen every September since 2017. Bitcoin has averaged an 8.5 per cent drop for the month over the past five years, according to Bespoke Investment Group.

Bullish market participants say the price decline is already being viewed as a buying opportunity for some investors.

“Under the hood, moreover, I think you’re seeing institutions gobble up coins when BTC drops below US$20,000,” said Krugljakow.