Jun 7, 2022

Bitcoin falls back below US$30,000 as range-bound trading persists

, Bloomberg News

Bitcoin pops back above US$30,000

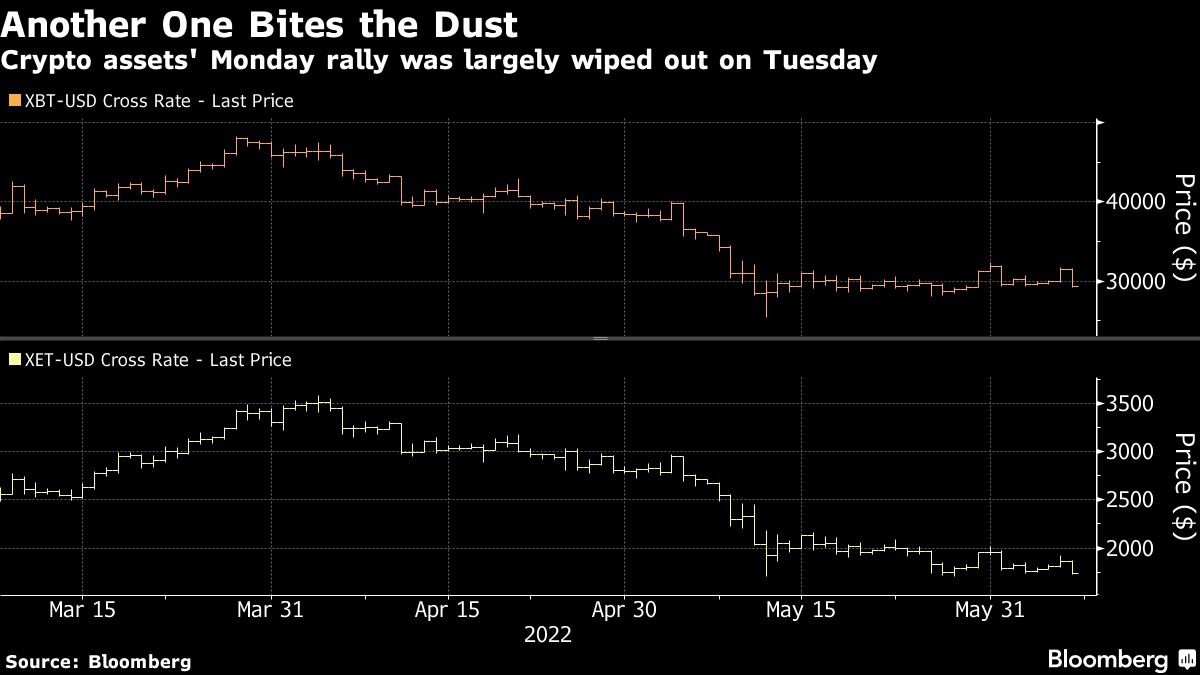

Bitcoin fell back below US$30,000, sliding along with equities and settling back into the middle of the narrow range where it’s been trading since mid-May.

Tuesday’s 6 per cent drop to around US$29,500 wiped out the previous three days of gains and ended Bitcoin’s second brief break above US$31,000 of the past three weeks. European equities and US futures also fell. Australia’s central bank delivered a bigger-than-expected rate hike to combat rising costs, adding to the risk-off mood in markets.

Investor concerns about tighter monetary policy and tougher regulations have dueled with optimism that Bitcoin may have found a bottom to keep the token in a tight range around US$30,000. Bitcoin faces “significant resistance” around US$31,500 to US$32,000, according to Marcus Sotiriou, an analyst at UK-based digital asset broker GlobalBlock.

“This market is languishing,” said Adam Farthing and Collin Howe of crypto liquidity provider B2C2 in a note. “Without a catalyst to the upside, current sentiment is likely to keep prices rangebound, with some clear and immediate risk of a break lower.”

The declines for crypto came as the dollar extended gains. A jump in Treasury yields late Monday fueled concerns that rising borrowing costs could induce a recession.

Adding to fears of tougher oversight, US regulators are investigating whether Binance Holdings Ltd. broke securities rules by selling digital tokens just as the crypto exchange was getting off the ground five years ago, Bloomberg reported on Monday.

Markets will continue to watch for signals that the current ranges -- US$28,000 to US$32,750 for Bitcoin, and US$1,700 to US$2,100 for Ether -- may break, B2C2 said in the note. Ether, the second-largest cryptocurrency, fell as much as 7.3 per cent and traded at US$1,747 at 12:40 p.m. in London.

Solana dropped as much as 11 per cent while Avalanche declined as much as 9.3 per cent in a trading session where all the major cryptocurrencies were in the red, Bloomberg data show.