Apr 23, 2023

Bitcoin ‘Halving’ Due Next Year Spurs Predictions of Rally in Token Past $50,000

, Bloomberg News

(Bloomberg) -- Bitcoin’s rebound is just the start of a rally that will take it past $50,000 next year courtesy of a process known as halving that curbs the supply of new tokens, according to projections from crypto analysts.

The largest digital asset has climbed 67% since Dec. 31 in a partial revival from an epic rout in 2022. While the token at the moment is struggling in the vicinity of $30,000, halving holds the potential to trigger an advance of at least 81%, according to Bloomberg Intelligence and Matrixport.

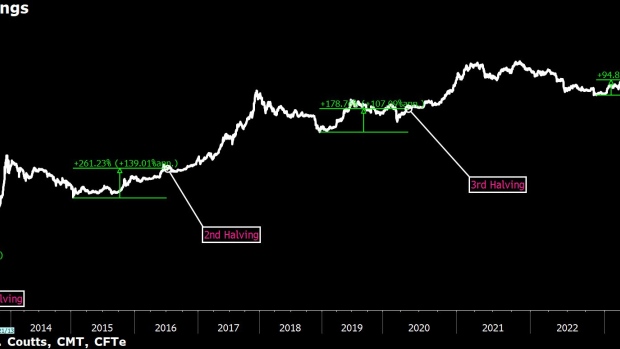

A halving – or halvening – cuts in half the amount of tokens that Bitcoin miners receive as reward for their work. The quadrennial event is due next around April 2024 and is part of the process of capping Bitcoin supply at 21 million tokens. The coin hit records after each of the last three halvings.

The upcoming halving is currently about 50% priced in based on previous cycles, said Jamie Douglas Coutts, a Bloomberg Intelligence analyst. Coutts predicts that Bitcoin can scale $50,000 by April 2024.

“Bitcoin cycles bottom around 12-18 months prior to the halving and this cycle structure looks similar to the past ones, albeit many things have changed — while the network is vastly stronger, Bitcoin has never endured a prolonged severe economic contraction,” he said.

The Bitcoin bounce has sputtered of late, restrained by cooling expectations of Federal Reserve interest-rate cuts amid persistent inflation. A US regulatory crackdown on crypto in the wake of the FTX exchange’s collapse in November 2022 also threatens to darken the market outlook.

FTX Low

“If the collapse of FTX was indeed the bottom of this cycle, then history would suggest that we still have approximately 350 days of ‘accumulation’ before witnessing the characteristic post-halving breakout price action,” said Jacob Joseph, an analyst at CCData.

Markus Thielen, research head at Matrixport, said in a recent note that Bitcoin will reach around $65,623 by April 2024 — more than double the current price.

Bitcoin remains about $41,000 down from its all-time high of almost $69,000 in November 2021 — which came 18 months after its 2020 halving. Crypto markets crashed last year as central banks jacked up rates to curb price pressures and digital-asset companies imploded.

“Bitcoin may once again reach a new all-time high in the future, however, it is unlikely to see the same growth as previous cycles due to increased market size and competition from other digital assets,” said CCData’s Joseph.

Bitcoin edged up less than 0.5% to $27,590 as of 8 a.m. in Singapore on Monday after retreating a little more than 9% last week. Smaller tokens like Ether, Cardano and Solana also made modest gains as the trading week got underway in the Asia-Pacific region.

©2023 Bloomberg L.P.