Dec 30, 2021

Bitcoin heads for US$29,000 in biggest monthly gain since 2019

, Bloomberg News

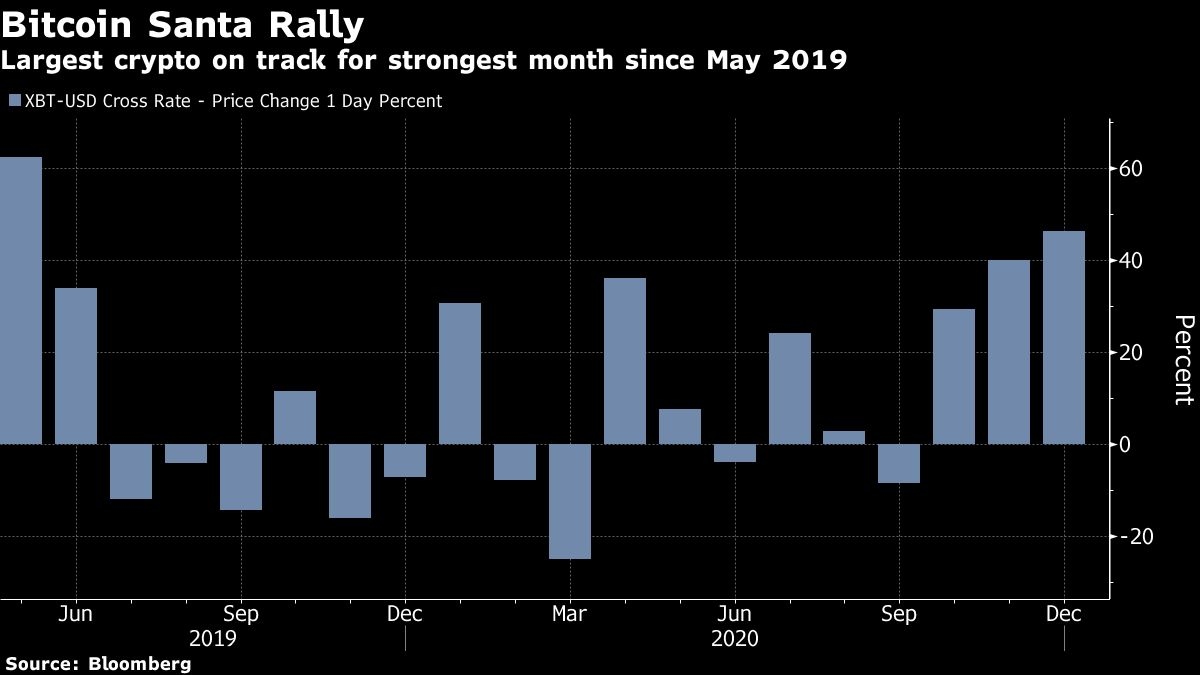

Bitcoin reaches new high, set for strongest monthly gain since 2019

Bitcoin it homing in on US$29,000 as the world’s largest cryptocurrency pushes its mindnumbing rally in 2020 past 300 per cent.

The digital asset surged above US$29,700 as of 3 p.m. Wednesday to a record. In December alone, Bitcoin has surged almost 50 per cent, putting it on track for its biggest monthly gain since 2019.

Bitcoin has now quadrupled in value this year amid the global coronavirus pandemic, while the wider Bloomberg Galaxy Crypto Index tracking the largest digital currencies is up about 270 per cent as rival coins such as Ether have also rallied.

The latest price surge continues to divide opinion between those who view cryptocurrencies as a hedge against dollar weakness and inflation risk, and others who question Bitcoin’s validity as an asset class given its speculative nature and boom-and-bust cycles.

“While a growing institutional presence has been part of the narrative of the current bull run, we may see increased retail interest in Bitcoin as a form of digital gold,” Paolo Ardoino, chief technology officer of crypto exchange Bitfinex said in an email.

Regulatory concerns also remain a wider factor for crypto investors. The Securities and Exchange Commission this month accused Ripple Labs Inc. and its top executives of misleading investors in affiliated token XRP. While Ripple plans to challenge the accusation in the courts, the development underscores the prospect of stricter oversight of digital assets.

XRP has plummeted almost 70 per cent this month and faces further pressure with Coinbase the latest exchange to announce plans to suspend trading in the token.