May 2, 2022

Bitcoin-Hoarding Miners Turn to Options Market for Cash Infusion

, Bloomberg News

(Bloomberg) -- Bitcoin miners are deploying their own version of “yield farming,” the often-discussed cryptocurrency money-making strategy, but with an old-school twist.

Publicly traded miners very much embrace the HODL, or “hold on for dear life,” mantra, hoarding tokens to make their stock more appealing to investors seeking exposure to Bitcoin’s gains. But these firms have major expenses; grinding through cryptographic puzzles to spawn new coins takes pricey computer hardware and giant power bills.

Instead of selling Bitcoin to raise money, firms like Marathon Digital Holdings Inc. are selling Bitcoin call options to wring money out of their holdings, turning to a yield-generating strategy deployed throughout conventional finance.

“Bitcoin miners are some of the most voracious yield seekers in the market today,” said Joshua Lim, head of derivatives at New York-based brokerage Genesis Global Trading, which offers options overwriting strategies to the industry.

Open Secret

The firms are exploiting an open secret in the options market: contracts frequently expire worthless. When that happens, the owner of the contract gets nothing, and the person -- in this case, a Bitcoin miner -- who sold it to them gets to keep whatever the buyer paid to purchase the option.

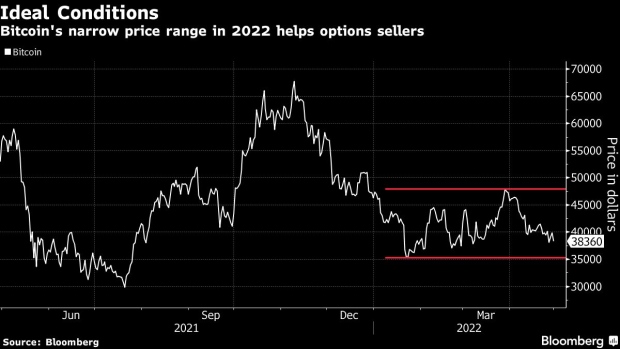

Bitcoin now trades around $39,000. If a miner sells a call with a $50,000 exercise price and Bitcoin fails to rise to that level by the time the contract expires, the miner makes money. Depending on the trade, annual returns, or yields, can get well into double-digit percentages, according to Lim.

But the strategy is not without risks. If Bitcoin hits the exercise price, miners start losing money. That risk can be mitigated by trading multiple contracts with different strike prices, but it’s something that has to be factored in.

Public miners have been on the lookout for yield-generating strategies to fund their rapid expansion without issuing new shares or debt. Other blockchains, most notably the second-largest one, Ethereum, have myriad ways to generate income, many of which fall under the umbrella of yield farming, a popular but sometimes-derided money-making strategy.

“We use call option straddles, where essentially you sell a call option and then buy one at a higher price so that you don’t miss out on the upside,” said Fred Thiel, chief executive officer of Las Vegas, Nevada-based Marathon. “Historically, it has generated more than 10% annually.”

Thiel targets generating yield -- using other techniques, too, including lending out Bitcoin -- from 25% of the company’s holdings.

Though Bitcoin has lost almost half its value since peaking in November, prices have been relatively stable lately. That can be helpful to options sellers, because it reduces the chance that the option strike price will be hit and the contract becomes profitable for the buyer. But miners could face losses if Bitcoin starts soaring again.

“When Bitcoin is in a range-bound market, this type of yield-generating strategy will outperform a mine-and-hold or mine-and-liquidate strategy,” Lim said. “However, in an upward trending market, miners will give up any upside performance beyond the strike of the calls they are selling.”

©2022 Bloomberg L.P.