Jan 31, 2023

Bitcoin Is About to Test the Adage ‘Don’t Fight the Fed’

, Bloomberg News

(Bloomberg) -- This year’s 40% rally in Bitcoin is heading toward a potentially big test in the shape of the upcoming Federal Reserve policy decision.

Crypto, stocks and bonds have jumped in the new year on expectations of a Fed pivot to slower interest-rate hikes and eventual cuts as high inflation cools. While the Fed appears set to downshift to a quarter-point increase Wednesday, Chair Jerome Powell may stress policy will stay restrictive to damp prices.

That could pour cold water on a $250 billion run-up in overall crypto market value in the past four weeks. The worry is a reminder of the old adage of “don’t fight the Fed,” coined in 1970 by the late investor Martin Zweig, who was pointing out the strong correlation between Fed policy and stocks.

The crypto “market is overly optimistic regarding a swift Fed pivot,” Vetle Lunde, senior analyst at Arcane Research, wrote in a note. Lunde added that “slowing momentum, strong technical resistance and expectations of a hawkish FOMC” point to a “poor February.”

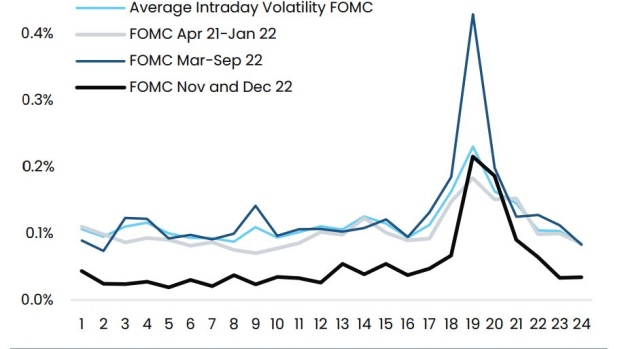

Arcane said an analysis of Bitcoin swings around the Fed’s recent post-decision briefings indicates that a “trend of massive FOMC-induced volatility in BTC is receding.” But it added traders should still brace when Powell speaks.

Bitcoin rose less than 1% and was trading at $23,118 as of 9:44 a.m. in New York. Smaller coins such as Avalanche and Dogecoin posted losses in the countdown to the Fed decision.

The Fed downshift is a macro driver for January’s digital-asset gains but the market in addition is saying that the worst of the crisis over the collapsed FTX exchange is behind us, Coinshares International Ltd.’s Chief Executive Officer Jean-Marie Mognetti said on Bloomberg Television.

Crypto-related stocks have also rebounded from last year’s rout. For instance, shares in the US-based exchange Coinbase Global Inc. surged 65% in January for their best monthly performance since the company’s listing in 2021. A index of crypto-mining equities registered an unprecedented month, soaring 77%.

The 2023 digital-asset rally has pared the one-year drop in a gauge of the top 100 tokens to 43%. A survey by LendingTree found that of the 28% of Americans who have held some form of digital asset, nearly 40% have sold it at a loss.

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

--With assistance from Joanna Ossinger.

©2023 Bloomberg L.P.