Jan 10, 2022

Bitcoin is off to its worst annual start since the dawn of crypto

, Bloomberg News

Why 'staking' is becoming an important part of crypto investing

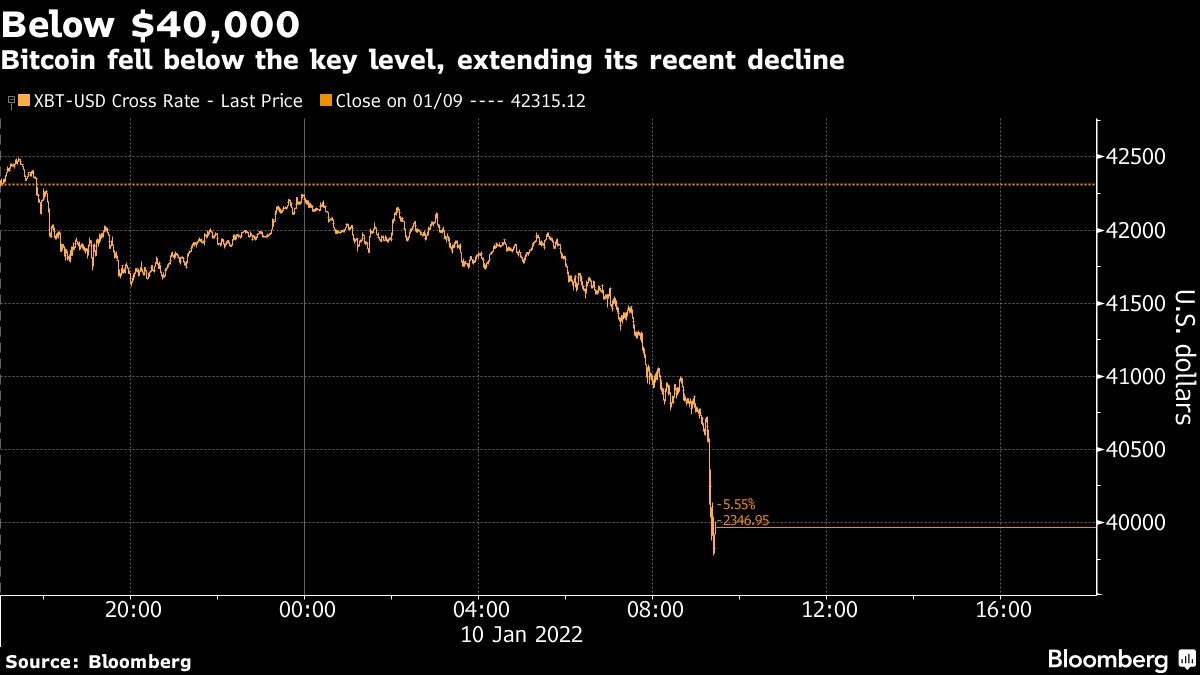

Bitcoin dipped below US$40,000 for the first time since September, putting it on pace for its worst start to a year since the earliest days of the digital alternative to money.

The original cryptocurrency bounced off the lows of the day after falling as much as 6 per cent to US$39,774 in New York trading, bringing its loss this year to about 14 per cent. The decline is the largest for a start of the year since at least 2012. It has slumped more than 40 per cent since reaching an all-time high of almost US$69,000 in early November.

“It has had a pretty shocking start to 2022,” said Fiona Cincotta, senior financial markets analyst at City Index. “There’s a lot going on. We know that Bitcoin is volatile but even for Bitcoin, we’re seeing some really big moves.”

Bitcoin, created in the wake of the 2008 global financial crisis by an anonymous individual or group that went by Satoshi Nakamoto, has still gained almost 500 per cent since the end of 2019. It first began trading in 2009 and pricing information from during the early days is limited.

The COVID-19 pandemic helped Bitcoin break further into the mainstream as institutions and retail investors got involved with the crypto market and its ancillary projects while governments and central banks provided record amounts of stimulus. Now that the Federal Reserve has turned more hawkish, riskier assets like stocks and digital assets have suffered.

“Cryptocurrencies are likely to remain under pressure as the Fed reduces its liquidity injections,” said Jay Hatfield, chief executive of Infrastructure Capital Advisors. “Bitcoin could end 2022 below US$20,000.”

Bloomberg Intelligence’s Mike McGlone said US$40,000 is an important technical support level for the digital token. Cryptocurrencies are a good barometer for the current reduction in risk appetite. But he projects that Bitcoin will eventually come out ahead as the world increasingly goes digital and the coin becomes the benchmark collateral.

“Tighter Fed policy affects not only interest rates but the equity risk premium as the Fed withdraws funds from the capital markets. Riskier investments such as unprofitable tech, meme stocks and cryptocurrency are disproportionately affected relative to the rest of the market since those investments are approximately twice as volatile as the overall market so have double the risk premium as the average stock,” said Hatfield.

Digital asset investment products saw outflows totaling a weekly record of about US$207 million, according to data compiled by CoinShares. Bitcoin saw about US$107 million in outflows, the asset management firm said.

Noelle Acheson, head of market insights at Genesis Global Trading, noted said Bitcoin’s slump appears to be driven more so by short-term traders of the coin than long-term holders. In fact, her analysis shows that long-term holders are “buying the dip.”