Oct 31, 2022

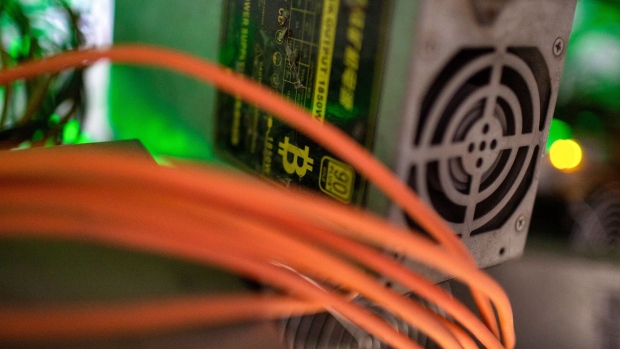

Bitcoin Miner Argo’s Shares Drop After Fundraising Fails

, Bloomberg News

(Bloomberg) -- Bitcoin miner Argo Blockchain Plc warned that it could be forced to shut down after a $27 million share sale appeared to have collapsed, sending the stock plummeting the most since its 2018 initial public offering.

Argo said in a statement on Monday that it raised about $5.6 million by selling almost 4,000 new Bitmain mining machines and is exploring other funding avenues.

“Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations,” Argo said in the statement.

The stock dropped as much as 73% and traded at £8.75 at 11 a.m. in London on Monday, down 44%. Argo has fallen about 90% this year, as a slump in cryptocurrency prices roiled the mining industry.

Read more: Bitcoin Miner Argo’s Shares Plummet as Liquidity Concern Rises

As the crypto bear market approaches the one-year anniversary of Bitcoin peaking at close to $69,000, the firms that mine the token are coming under financial strain. Core Scientific Inc., one of the world’s largest miners of Bitcoin, last week warned that it may run out of cash by the end of the year and could seek relief through bankruptcy protection.

Compute North Holdings Inc., a provider of data services for miners and blockchain companies, filed for bankruptcy in September.

©2022 Bloomberg L.P.