Nov 2, 2022

Bitcoin Miner Iris Flags Risk of Default on $103 Million of Debt

, Bloomberg News

(Bloomberg) -- Iris Energy Ltd. is the latest Bitcoin miner to grapple with debt trouble because of the sharp market downturn for digital assets.

The Sydney-based green crypto miner, which listed in the US last year, said in a statement on Wednesday that some of its mining equipment isn’t making enough cash to cover related debt-financing obligations.

The firm said $103 million of debt is secured against the rigs via a couple of wholly-owned special purpose vehicles. It doesn’t plan to provide further financial support for the vehicles absent a refinancing agreement.

That means a default on the loans looms on Nov. 8 when a scheduled principal payment is likely to be missed, according to the Iris statement.

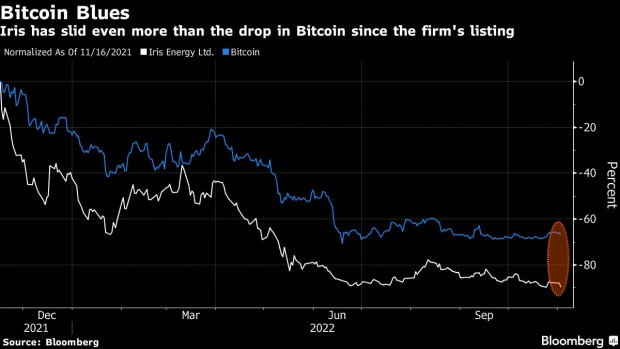

Bitcoin has shed about 70% since a record high in November 2021, sapped by a pivot from the ultra-low interest rates characteristic of the pandemic to sharply tightening monetary policy to fight inflation.

In addition to declining demand for the world’s largest digital currency, miners have also had to contend with rising energy costs and power restrictions.

The squeeze on profits has resulted in miners dipping into their Bitcoin stockpiles for quick cash. Iris Energy, Argo Blockchain Plc and Core Scientific Inc. have also sold equity to raise funds. A group of Core Scientific bondholders tapped Moelis & Co to manage debt talks with the beleaguered miner.

Iris Energy said restructuring discussions with the lender to the special purpose vehicles are ongoing. It said the idea behind setting up the vehicles was to achieve “prudent risk management to protect the underlying business and data center infrastructure” of the company.

At a group level Iris said it has $53 million of cash in the bank. The shares slid 15% Wednesday to a record closing low and are down some 90% since listing.

©2022 Bloomberg L.P.