Jun 1, 2023

Bitcoin Miners Are Churning Out More Computing Power Than Ever

, Bloomberg News

(Bloomberg) -- Bitcoin miners are producing more computing power than ever with powerful specialized computers.

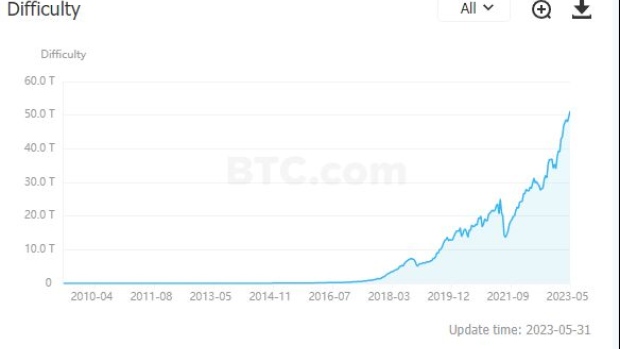

Mining difficulty, a measure of computing power to earn Bitcoin, reached an all-time high on Wednesday, according to data from btc.com. The bi-weekly update posted a 3.4% increase after another 3.22% jump during the last period. It has been on the rise with only two slight declines this year.

While the value of Bitcoin is still worth less than half of that during the last bull run in 2021, a steady rebound in the digital asset this year has prompted the miners to resume or expand their mining operations. A drop in electricity costs and a new wave of more efficient machines are also contributing to the climb in computing power.

That has helped to more than double the share prices of miners including Marathon Digital Holdings Inc. and Riot Platforms Inc. this year. Still, the more mining power there is, the less Bitcoin each miner will receive as the network only gives a limited amount of the token reward after successfully processing a certain amount of data.

“Bitcoin miners are enjoying cheaper electricity before heading into the summer,” said Wolfie Zhao, head of research at TheMinerMag, a research arm of crypto-mining consultancy BlocksBridge. “Newer and more efficient machines also generate more computing power with the same amount of energy.”

Gross margin of major public mining companies has improved during the first quarter, according to data from public filings compiled by TheMinerMag. Bitcoin miners faced one of the most challenging times during the last quarter when the cold weathers in crypto-friendly states such as Texas sent electricity prices soaring and the persistently low Bitcoin prices triggered liquidity crunch and bankruptcies among top mining companies such as Core Scientific Inc.

The miners are also trying to increase efficiency of their mining operations by acquiring new machines or deploying more effective cooling systems for the machines before a change in Bitcoin’s code, called the halving, comes next year. That change will cut Bitcoin rewards, which are the main source of revenue for miners, in half. The Bitcoin blockchain is due to hit its 21-million cap in about 2140.

©2023 Bloomberg L.P.