Mar 1, 2021

Bitcoin Rises as Citi Makes the Case for a Role in Global Trade

, Bloomberg News

(Bloomberg) -- Bitcoin rallied after a volatile weekend session, riding a broad resurgence in risk assets and a bullish report from Citigroup Inc.

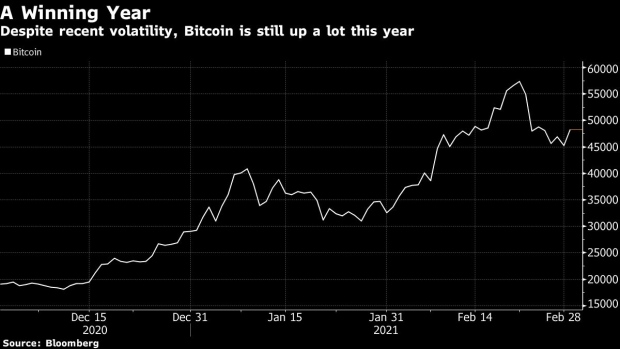

The world’s largest cryptocurrency jumped as much as 7.2% to trade around $48,500 in early U.S. trading on Monday. Prices last week suffered the worst decline since March and dipped as low as $43,000 on Sunday. Bitcoin climbed to a record $58,350 on Feb. 21.

In a report by Citigroup’s Global Perspectives & Solutions, strategists laid out a case for Bitcoin to play a bigger role in the global financial system, saying the cryptocurrency could become “the currency of choice for international trade” in the years ahead. Bitcoin has advantages over the current global payment system, such as its decentralized design, lack of foreign exchange exposure and traceability, the strategists said.

“There are a host of risks and obstacles that stand in the way of Bitcoin progress,” wrote strategists including Kathleen Boyle, the managing editor of Citi GPS. “But weighing these potential hurdles against the opportunities leads to the conclusion that Bitcoin is at a tipping point and we could be at the start of massive transformation of cryptocurrency into the mainstream.”

Citigroup’s full-throated backing of Bitcoin shows that crypto is continuing to win over the world’s biggest financial institutions. Dan Loeb, head of Third Point LLC, said in a Twitter post that he’s been “doing a deep dive into crypto lately,” adding that “it is a real test of being intellectually open to new and controversial ideas.”

Bitcoin plunged slumped 21% last week as investors dumped speculative assets amid a run-up in bond yields. The volatility has raised questions about whether it can act as a store of value and hedge against inflation. Detractors have maintained the digital asset’s surge is a speculative bubble and it’s destined for a repeat of the 2017 boom and bust.

“Some speculative overleveraging on the side of the retail triggered this mini correction, the rebound from which we are seeing today as new players are quickly buying into the market,” said Antoni Trenchev, managing partner and co-founder of Nexo in London.

Crypto Mining

Elsewhere, China’s Inner Mongolia banned cryptocurrency mining and declared it will shut all such projects by April, spurring concern the communist nation will take more steps to eradicate the power-hungry practice.

The autonomous region, a favorite among the industry because of its cheap power, also banned new digital coin projects, according to a draft plan posted on the Inner Mongolia Development and Reform Commission’s website Feb. 25. The aim is to constrain growth in energy consumption to about 1.9% in 2021.

The sheer amount of energy needed to mine Bitcoin and the prospect that governments will create more obstacles for the largest cryptocurrency point to the token losing “most of its value over time,” BCA Research Chief Global Strategist Peter Berezin wrote in the report released Friday.

©2021 Bloomberg L.P.