Oct 26, 2022

Bitcoin Rises Toward $21,000 After Rediscovering Seasonal Trend

, Bloomberg News

(Bloomberg) -- Bitcoin is back on track to respect a history of climbing in October amid speculation that the Federal Reserve is getting closer to pivoting toward less aggressive interest-rate hikes.

The largest token has jumped nearly 7% in the past two days and is up a similar amount for the month so far. That’s still short of the average 22% gain in October over the past decade, according to data compiled by Bloomberg.

The picture was less rosy at the start of the week, when Bitcoin was nursing an October loss that suggested it was set to defy the seasonal trend. But some recent Fed comments alongside mixed US economic data have buttressed bets on a slowdown in the monetary tightening that’s pummeled risk assets in 2022.

The Fed may be starting to show some signs of potentially pivoting, Nick Hotz, vice president of research at digital-asset manager Arca, said in an interview. “From a more macro markets standpoint there’s definitely a lot on the short side,” he said. “If people close those shorts, it could drive the price higher.”

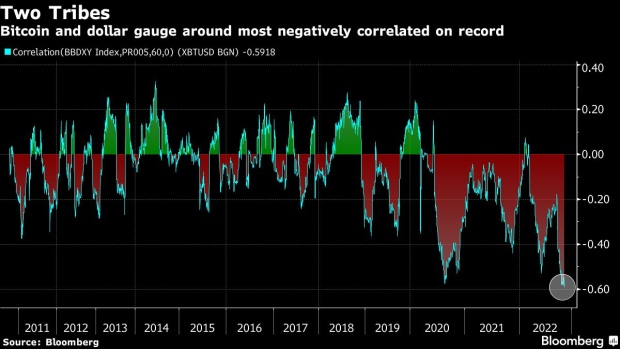

Scaled back Fed expectations are apparent in a slide in the dollar this week. At the same time, a 60-day correlation coefficient between Bitcoin and a dollar gauge is around the most negative on record.

Bitcoin climbed more than 2% to trade around $20,700 as of 10 a.m. in London, while second-ranked Ether added 4% to roughly $1,540.

©2022 Bloomberg L.P.